How to Create a Voided Check With or Without a Checkbook

Creating a voided check is simple: just take a blank check from your checkbook and write the word "VOID" across the front in large, clear letters. That’s it. This step instantly makes the check unusable for payment but keeps the important stuff—your account and routing numbers at the bottom—perfectly readable.

This is exactly what companies need to set up direct deposits or automatic payments.

Why You Still Need a Voided Check in a Digital World

It seems a bit old-school, right? We pay for almost everything with a tap or a click, so why would anyone need a piece of paper? But the humble voided check still plays a surprisingly critical role in finance. Its main job is to share your banking information in a way that's secure and pretty much foolproof.

Think of it as the physical proof of your digital account details. When you hand over a voided check, you're not just rattling off some numbers. You're giving someone tangible confirmation that the account is real, it's active, and it actually belongs to you. This is why so many organizations still prefer it over just typing numbers into a form.

The Power of Verification

The real reason voided checks are still around is that they kill the risk of human error. It’s incredibly easy to mistype a number when you're filling out an online form. One wrong digit in your account number could send your paycheck into someone else's account or cause your rent payment to bounce. It's a headache you don't need.

A voided check lets payroll departments or utility companies scan the numbers directly from a bank-issued document. This dramatically cuts down the chances of a costly typo.

This isn't a new idea. The practice dates back to the 1970s when electronic fund transfers first started becoming popular for payroll. Even today, it’s a trusted method. A 2019 survey found that 68% of U.S. employers still asked for voided checks from new hires. Why? Because it can reduce fraud risk by as much as 40% compared to just having someone type their details in, a finding you can read more about in this financial security report.

Key Takeaway: A voided check isn't just about sharing numbers; it’s about verifying account ownership and preventing manual entry errors that can delay crucial payments like your salary or rent.

Common Scenarios Where a Voided Check is Essential

So, when are you actually going to need one? You’ll probably run into a request for a voided check in a few common situations. Knowing what they are ahead of time can save you some hassle.

Here's a quick look at the most frequent situations where you'll be asked to provide a voided check and why it's necessary.

Common Scenarios Requiring a Voided Check

| Use Case | Why It's Required | Who Typically Asks |

|---|---|---|

| Setting Up Payroll Direct Deposit | To confirm your bank account and routing numbers are correct, ensuring your paycheck lands in the right place without delay. | New Employers, HR Departments |

| Arranging Automatic Bill Payments | To establish a secure link for recurring ACH withdrawals for things like rent, utilities, or loan payments. | Landlords, Utility Companies, Lenders |

| Establishing Investment Accounts | To verify the funding source for an investment or brokerage account, proving ownership and preventing fraud. | Brokerage Firms, Financial Institutions |

| Receiving Tax Refunds | To provide your tax preparer or the IRS with a foolproof way to set up a direct deposit for your refund. | Tax Preparers, IRS |

Ultimately, a voided check serves as an official, bank-verified instruction slip. It’s a simple, low-tech solution that prevents high-tech problems.

How to Properly Void a Physical Check

When you need a voided check, getting it right the first time is key. It sounds simple, but a few small mistakes can get your direct deposit or automatic payment setup rejected, causing annoying delays. The whole point is to make the check unusable for payment while keeping your account details crystal clear.

First things first, grab a blank check from your checkbook. You'll also need a pen—specifically one with permanent blue or black ink. Steer clear of pencils or markers that might bleed and smudge the numbers at the bottom. Those numbers are the entire reason you're doing this.

The Right Way to Write "VOID"

Take your pen and write "VOID" in big, bold letters across the face of the check. You want there to be zero doubt that this check can't be cashed. I usually write it on a diagonal, stretching from the bottom-left to the top-right, so it crosses over the payee line and the amount box.

Now for the most important part: whatever you do, don't let the word "VOID" cover up the numbers at the bottom. That string of numbers is the MICR (Magnetic Ink Character Recognition) line, and it contains your bank's routing number and your account number. If the recipient can't read those digits, the whole thing is useless.

Pro Tip: Never, ever sign a voided check. A signature is what authorizes payment. Even with "VOID" written across it, a signed check is a security risk you don't need. Just leave that signature line completely blank.

Once you’ve written "VOID" across the check, you're done. There's no need to fill in the date, payee, or amount. It's now officially voided and ready to go.

Sending Your Voided Check

Preparing the check is only half the battle; you also have to send it correctly. These days, most places are perfectly happy with a digital copy.

Here are the best ways to get it to them:

- Take a Clear Photo: Your smartphone is your best friend here. Just make sure the lighting is good, there are no weird shadows, and all four corners of the check are in the frame. Double-check that the MICR line is sharp and readable before you hit send.

- Scan It: If you have a scanner, use it. A scan creates a perfectly flat, high-quality image that’s easy for automated systems to read. A PDF or JPEG file is the standard format.

- Make a Photocopy: For handing it in person, a good old-fashioned photocopy works great. Just glance at the copy to confirm the routing and account numbers are dark and legible before you part with it.

Following these simple steps ensures you create a compliant voided check that works on the first try, getting your payroll or automatic payments set up without a hitch.

Creating a Voided Check Without a Checkbook

It’s a common situation these days: you’re asked for a voided check, but you haven’t seen your checkbook in years. Who even uses them anymore? The good news is, you don’t need one.

Needing to create a voided check no longer means a frustrating wait for a new box of checks to arrive in the mail. You’ve got faster, more modern options that get the job done just as well. Most major banks have caught on and now offer digital solutions right inside their online portals.

Accessing Digital Banking Tools

Your first move should be to log into your bank’s website or mobile app. Banks like Chase, Bank of America, and Wells Fargo have made it incredibly easy to find the documents needed for direct deposit or automatic payments. Once you’re in, start looking for a section labeled something like "Account Services" or "Account Information."

Inside, you’ll usually find a few different options:

- Direct Deposit Information Form: This is the most common solution. It's a pre-filled PDF that has your name, full account number, and routing number all laid out. It works perfectly as a substitute for a voided check.

- Digital Voided Check Image: Some banks go a step further and let you generate an actual image of a voided check from your dashboard. It looks just like the real thing and has all the necessary info.

- Bank Letter on Official Letterhead: Another great option is to download an official letter from your bank that formally lists your account details for verification.

The image above gives you an idea of where to look. Once you navigate to your checking account details, keep an eye out for links mentioning direct deposit or account forms—that’s where these digital tools are usually hiding.

Exploring Other Checkless Solutions

If you strike out online or just prefer a different method, you’re not out of luck. One of the most reliable fallbacks is simply walking into a local branch.

Just go up to a teller and ask for a counter check. They can print a single, official check for you on the spot. You can then void it and be on your way. Some banks do this for free, but others might charge a small fee, so it’s always a good idea to ask first.

Another route that’s gaining traction is using an online check generator. The demand for these tools is a clear sign of how much our banking habits have changed. In fact, the use of online void check generators has shot up by 300% since 2020. In response, big players like Chase and Wells Fargo have started offering digital voided images to roughly 40% of their customers since 2021, helping bridge the gap for a checkless generation.

When using any third-party service, your security has to come first. Make sure the platform uses strong encryption and has a privacy policy that clearly states your financial data isn't being stored.

For a reliable and secure option, a trusted service can generate a compliant voided check in seconds. With the right tool, you can instantly create a professional voided check online and get your payroll or payment setup completed without a hitch.

Safely Sharing Your Banking Information

When you void a check, you're essentially creating a direct map to your bank account. It has everything on it: your full name, address, bank routing number, and the entire account number. It's a goldmine of sensitive data, so you have to be extremely careful with it.

Before you even think about sending that information off, pause and confirm who's asking for it. Is this a legitimate request from the HR department at your new job? Is it a well-known utility company setting up autopay? A quick phone call or a separate email to a known contact can save you a world of trouble and ensure your details don't end up in the wrong hands.

Choosing a Secure Transmission Method

How you send the voided check is just as critical as who you're sending it to. Never, ever just attach it to a standard email. Email is like a postcard—it can be easily intercepted and read by others along the way.

You need a secure channel. Thankfully, many businesses now use encrypted online portals for onboarding employees or setting up vendor payments. These systems are built from the ground up to protect sensitive documents.

If you don't have access to a secure portal, here are some solid alternatives:

- Secure File Upload: Many companies will provide a specific, secure link for you to upload documents directly to their system.

- Hand Delivery: If it's a local landlord or employer, walking a physical copy over is about as safe as it gets.

- Fax Machine: It might feel like a relic from another era, but faxing is often more secure for direct point-to-point transmission than a standard email.

Key Insight: A photo of your voided check is just as sensitive as the physical paper. Avoid sending it through standard text messages or unencrypted email whenever you can.

Keeping Your Own Records

After you’ve sent your information, there's one last step for your own protection. It’s a smart habit to keep a simple record of who you've given your banking details to. This doesn't need to be anything fancy; a quick note in your phone or a simple spreadsheet works perfectly.

Just jot down the date, the company or person's name, and why they needed it. This creates a personal audit trail, making it much easier to connect the dots if you ever spot a weird transaction on your bank statement. This simple habit is a powerful tool for fraud prevention, especially since ACH network fraud attempts in the US jumped 23% to $2.4 billion in 2023.

To explore the details of financial regulations, you can learn more about how voided checks are a key part of business compliance and security.

It's also essential to understand how any service you use handles your data. For example, you can read about our commitment to data privacy to see how we work to protect your information.

Hitting a Snag? Troubleshooting Common Voided Check Problems

So, you’ve followed all the steps to void a check, but it still got rejected. It’s frustrating, I know, especially when you’re trying to set up something important like your paycheck. The good news is that the fix is almost always straightforward once you figure out what went wrong.

Usually, the problem boils down to just a few common mistakes. Maybe the person on the other end can't clearly read the numbers, which can happen if your pen bled through or the photo you sent was blurry. Remember, the whole point of a voided check is to provide crystal-clear account information, so legibility is everything.

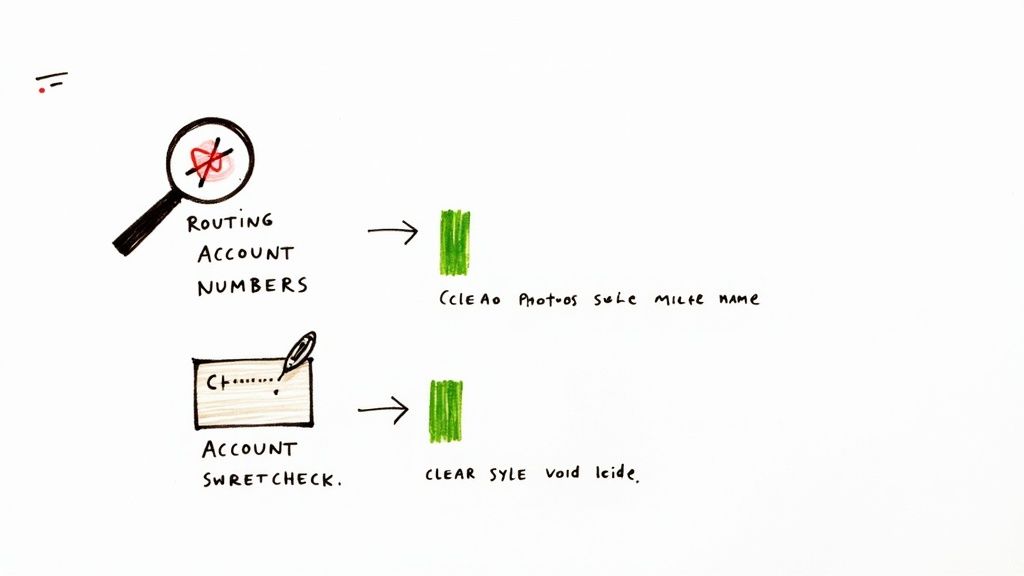

Illegible MICR Line or Information

The most common culprit is an unreadable MICR (Magnetic Ink Character Recognition) line. That’s the special string of characters at the bottom of the check that contains your routing and account numbers. If you accidentally wrote "VOID" over this line or the ink smudged, the automated systems used for payroll simply can't read it.

The fix? Grab a new check and start over. This time, make sure your writing is well clear of that critical bottom edge. When you send it, take a well-lit photo from directly overhead or use a scanner to ensure every number is sharp and easy to read.

Incorrect or Outdated Information

Another frequent hang-up is when the personal details printed on the check are out of date. This happens all the time if you've recently married, legally changed your name, or moved.

If the check still has your old name, it’s an almost guaranteed rejection. The name on the check has to perfectly match the name you're using for the new payroll or payment account.

For Name Mismatches: The best long-term solution is to order new checks from your bank with your updated legal name. If you're in a pinch and need something now, call your bank and ask for an official direct deposit form or a bank letter. These documents serve the same purpose and will have your current information.

For Old Addresses: An old address is usually less of a deal-breaker, but it can still raise a red flag or cause confusion. While many employers won't mind, it's always best practice to use a check that reflects your current address to avoid any potential snags.

The entire reason we use a voided check is to prevent the manual entry errors that cause 15-20% of payment delays. According to a revealing business payments report, these small mistakes cost businesses a mind-boggling $15 billion annually. A clean, clear voided check helps automated systems slash error rates from 2% all the way down to less than 0.1%.

Your Voided Check Questions Answered

Even after walking through the steps, a few questions always seem to pop up. Think of this as the "go-to" spot for those lingering details and common hang-ups people run into when making a voided check.

Can I Just Use a Deposit Slip Instead?

Ah, the classic question. It makes sense to ask—a pre-printed deposit slip has all the same key info: your name, account number, and routing number. And honestly, for many employers, that's good enough.

But here’s the catch: it’s not a universal substitute. Some payroll systems are pretty rigid and are built to scan the specific MICR line found only at the bottom of a check. A deposit slip just won't work in those cases, and it'll get rejected.

My Advice: Before you send anything, just ask. A quick email to your HR contact or the billing department can save you a ton of hassle. If they give you the green light for a deposit slip, great! If not, you know you need to stick with a standard voided check.

What’s the Difference Between a Voided and a Canceled Check?

The terms "voided" and "canceled" sound like they could be interchangeable, but in the banking world, they're worlds apart. Getting this right is crucial.

- A Voided Check: This is a blank check that you’ve deliberately made unusable by writing "VOID" on it. It was never part of a transaction and can't be cashed. Its only job is to provide your account details safely.

- A Canceled Check: This is a check that has already done its job. You wrote it to someone, they deposited it, the money was moved from your account, and your bank "canceled" it so it can never be used again.

Basically, a voided check is stopped before a transaction can even begin. A canceled check has already completed its journey.

Is It Safe to Email a Picture of My Voided Check?

This one is a hard "no," if you can help it. Sending sensitive financial information over standard, unencrypted email is like sending a postcard with your bank details written on the back—anyone could potentially see it.

The best and safest way is to use a secure online portal, which most employers provide for onboarding documents. This is your top choice. If that isn't an option, ask if you can drop off a physical copy or use a secure file-sharing service that encrypts the data from end to end. Treat email as your absolute last resort, and only use it if you have no other choice and fully trust the recipient.

There's a good reason for this caution. The Social Security Administration now sends 99% of its 70 million monthly payments via direct deposit. This simple process, often started with a voided check, is critical for preventing the kinds of errors that used to cost the government around $500 million annually. You can read more about why this simple document is so important for financial accuracy in this detailed ecommerce hub article. Your financial info is just as important, so it’s worth protecting.

Don't have a checkbook? No problem. With VoidedCheck.org, you can create a professional, compliant voided check in under 60 seconds. Our secure service validates your bank information against Federal Reserve data, ensuring universal acceptance for payroll, direct deposits, and automatic payments. Get your instantly formatted voided check now at https://voidedcheck.org.

Related Articles

Generate Check Online: Create a Check in Seconds (generate check online)

Need to generate check online? Learn a fast, secure way to create a check for direct deposit or bill pay with our step-by-step guide.

How to create voided check online Instantly

Learn how to create voided check online for direct deposits or ACH payments. Our secure, step-by-step guide makes it fast and easy.

A Practical example of voided check: how to void and set up payments

Looking for an example of voided check? This step-by-step guide shows how to void a check correctly and offers safe, modern direct deposit alternatives.