Create a voided check online: Fast, secure, and simple

Need to set up direct deposit or an automatic bill payment? You might be surprised when they ask for a voided check. Even in our digital-first world, this simple document remains a trusted way to verify your banking information. The good news is you don't need a dusty checkbook anymore. You can create a compliant voided check online using a secure generator to input your routing and account numbers, getting the document you need instantly.

It's a fast and secure alternative to digging out a physical check, and it gives employers and billing companies exactly what they need to get you paid or process your payments correctly.

Why Voided Checks Still Matter

It can feel a bit old-school, but the reason a voided check is still the gold standard for verifying bank details is all about preventing errors. A single mistyped digit in your account number could send your paycheck or mortgage payment into the wrong account—a headache nobody wants.

A voided check acts as an undeniable, official record of your account information. There's no guesswork involved, which is why it's still so trusted.

The Gold Standard for Verification

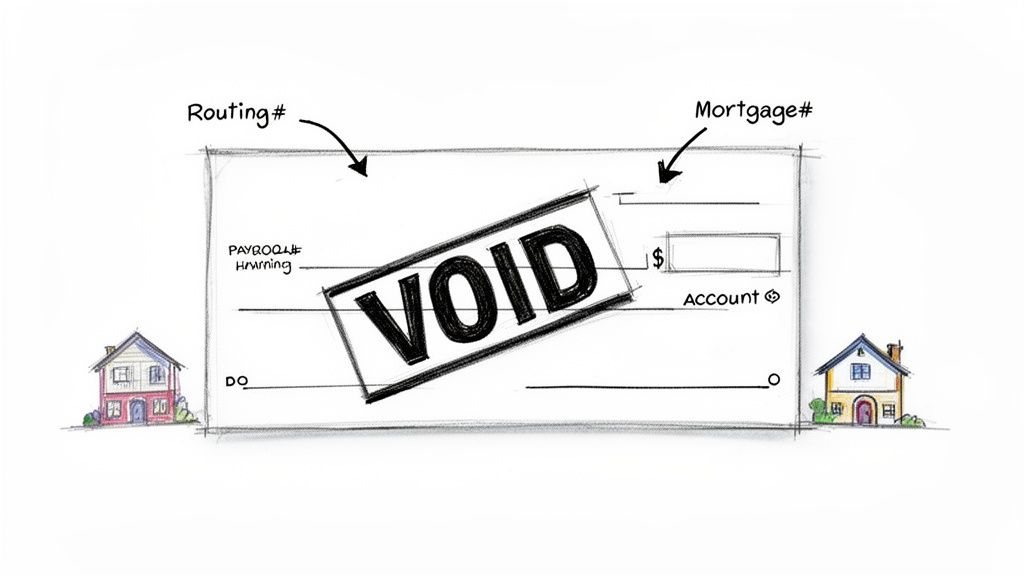

Think of a voided check as the ultimate proof of your account details, all laid out in a format that both people and payment systems understand. It clearly shows three key pieces of information:

- Your full name and address, confirming they match what your bank has on file.

- The bank's nine-digit routing number, which acts like a street address for your financial institution.

- Your unique account number, which is the specific "mailbox" for your funds.

Presenting this information on a check—even a digitally generated one—removes the risk of manual entry errors. It’s a simple layer of security that ensures everyone is on the same page.

A voided check isn't for spending money. It's an instruction manual showing exactly where money should go. Writing "VOID" across it ensures the manual itself can never be used as a payment.

Even though it seems like a small step, providing a voided check is often a required part of setting up important financial relationships.

Here’s a quick look at the most common situations that require a voided check to verify your banking information.

When You Need a Voided Check

| Use Case | Why It Is Needed | Who Is It For |

|---|---|---|

| New Job Direct Deposit | To securely provide your employer with accurate routing and account numbers for payroll. | HR Departments, Payroll Processors |

| Automatic Bill Payments | To set up recurring payments for utilities, rent, or a mortgage, ensuring funds are pulled correctly. | Utility Companies, Landlords, Lenders |

| Brokerage/Investment Accounts | To link your bank account for seamless electronic fund transfers (ACH). | Brokerage Firms, Investment Platforms |

| Government Payments | To receive tax refunds or other government benefits directly into your account. | IRS, Government Agencies |

As you can see, a voided check serves a very specific purpose: to create a reliable, error-free link between your bank account and another party.

Meeting Modern Payroll Demands

Direct deposit is how most of us get paid these days. In fact, an incredible 91% of the U.S. workforce—that's over 140 million people—received their pay electronically in 2023. You can explore more insights on this from Nacha.org's direct deposit verification resources.

Despite this digital shift, HR departments still need to verify those banking details. This is where the need to create a voided check online comes in. Many people, especially those just starting their careers, don't even own a physical checkbook. Online generators fill this gap perfectly, letting anyone produce a professional, compliant document in just a few clicks so they can get their paycheck set up right away.

Getting Your Voided Check Made Online

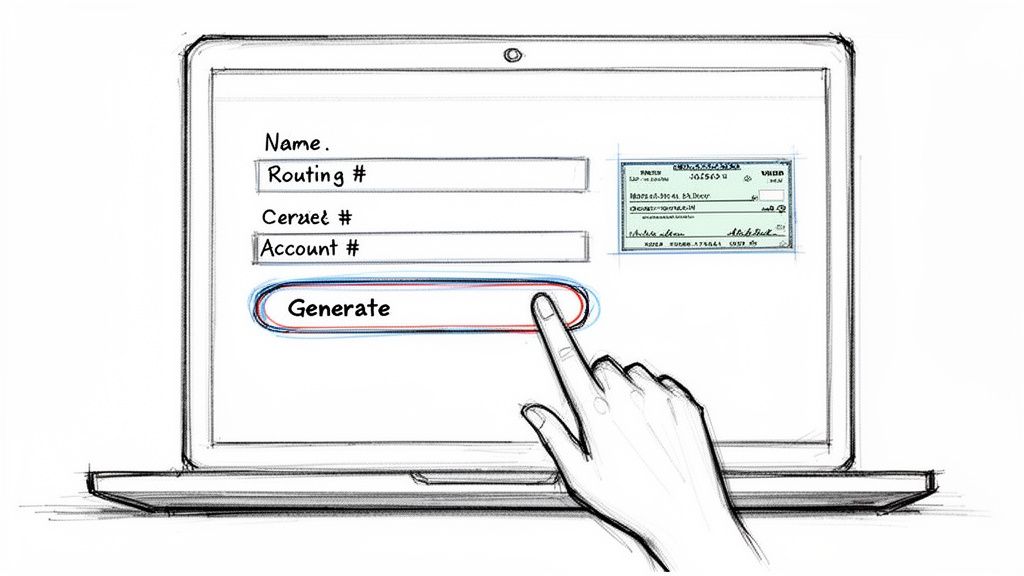

What you see above is basically the modern-day checkbook. Instead of digging for a physical check, you can use a simple online form like this to create a perfectly valid document in just a few clicks.

Creating a voided check online is surprisingly fast—it honestly takes less than a minute. You can skip the trip to the bank or the wait for a new checkbook in the mail. The only trick is having the right numbers on hand before you start.

First, Find Your Account Details

You'll need two key numbers to get this done: your bank's routing number and your account number. These are the exact same numbers you'd find at the bottom of a paper check.

Don't have a checkbook? No problem. The easiest way to find them is to log into your bank’s website or mobile app. They’re almost always listed under "Account Details" or a similar section.

Here are the most common places to look:

- Your Online Banking Dashboard: Click on your checking account, and the numbers are often right there at the top.

- Bank e-Statements: Your full routing and account numbers are always printed on your monthly PDF statements.

- The Bank’s Direct Deposit Form: Most banks have a pre-filled direct deposit form you can download. It’s a goldmine for this information.

I always recommend copying and pasting these numbers directly from your bank's site. It’s a simple move that prevents typos, which can cause frustrating payment delays or rejections down the line.

Now, Enter Your Information with Care

With your numbers in hand, it's time to plug them into a secure online tool. This is the part where you want to be meticulous. A good online generator will walk you through the fields, but it's up to you to ensure every detail is correct.

You’ll be asked for a few basics:

- Bank Routing Number: The nine-digit code that identifies your bank.

- Bank Account Number: Your specific account identifier.

- Your Full Legal Name: Make sure this matches your bank account record exactly—no nicknames.

- Your Current Address: Again, this needs to match what your bank has on file for you.

Pro Tip: Some banks have different routing numbers for different purposes. Look for the one specifically designated for "ACH" or "Electronic Transfers." If you accidentally use the number for wire transfers, your direct deposit setup will likely fail.

Once everything is entered, you should see a preview of your check. Stop and give it a final once-over. Is your name spelled right? Is the address correct? Are the routing and account numbers a perfect match? This is your last chance to catch any small mistakes.

Finalize, Download, and Share

Once you’ve confirmed all the details are correct, you're ready to create the document. You can use an online tool like our easy-to-use voided check generator to instantly make your check.

The final document will usually be delivered to your email as a high-quality PDF or PNG file. This digital format is perfect for today’s payroll and billing systems. From there, you can upload it directly to an HR portal or email it to whoever requested it. It’s a clean, quick, and professional way to meet an old-school requirement.

Verifying Security and Ensuring Acceptance

Handing over your banking details to any website can feel a little unnerving. I get it. When you’re creating a voided check online, you’re trusting a service with sensitive data, so let’s talk about what makes this process genuinely safe.

The absolute top priority is making sure your information is protected from the second you type it in. That’s where good old encryption comes into play.

Protecting Your Financial Data

You'll want to look for services that clearly state they use 256-bit SSL encryption. This isn't just some tech jargon; it's the same security standard your own bank uses. It essentially scrambles your data during transit, making it completely unreadable to anyone trying to snoop.

But here’s the real kicker: a trustworthy online check generator should have a strict no-storage policy. This is the feature that should give you true peace of mind.

- Data Encryption: This keeps your routing number, account number, name, and address locked down and secure as it travels online.

- No-Storage Policy: Your financial info should be permanently wiped from the server the instant your check is generated and delivered to you.

- Secure Payment Processing: If there's a fee, it should be processed through a reputable gateway like Stripe. This means the check service itself never even sees your credit card number.

A service that doesn't store your data cannot lose it in a breach. This is a simple but powerful security promise. Once your transaction is complete, your information vanishes from their system, which is exactly what you want.

When you think about it, this combination of encryption and immediate data deletion often makes creating a voided check online safer than emailing a scanned copy of a physical check, which can sit unencrypted in your sent folder and someone else’s inbox indefinitely.

Gaining Universal Acceptance

Of course, a digitally created voided check is pretty useless if your employer or billing company won’t take it. This is where legitimacy and compliance become just as critical as security. The best services are built from the ground up to ensure their documents are accepted everywhere.

Even with all the digital payment options out there, paper checks are still a massive part of the U.S. financial system. As of 2024, a staggering 14.5 billion checks worth $25.8 trillion are still processed each year. Voided checks are the unsung heroes here, with 82% of direct deposit setups still relying on them for bank account verification. You can see more in this detailed breakdown of check usage statistics.

To meet this need, online tools make sure their generated checks are fully compliant with major payroll and HR platforms like ADP, Gusto, and QuickBooks. They achieve this by validating every routing number against the official Federal Reserve database.

You can even double-check your own bank’s routing number with our handy bank verification tool. This validation step is key—it confirms the banking information is legitimate and formatted correctly, which practically eliminates the risk of rejection from a typo or an old, inactive number. That built-in accuracy check is what gives you the confidence that your voided check will work without a hitch.

Fixing Common Mistakes When Things Go Wrong

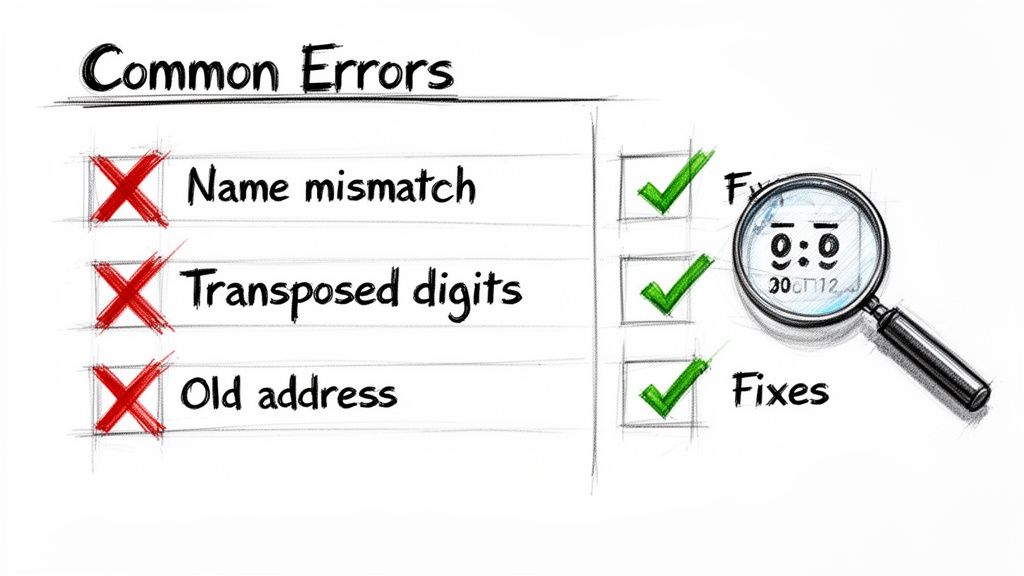

Even when you're careful, a simple typo can throw a wrench in the works, delaying a direct deposit or causing a bill payment to bounce. It’s frustrating, but the good news is that these problems are almost always easy to spot and quick to fix.

The most common issue I run into is a simple mismatch between the info you type in and what your bank officially has on file. This is where a little bit of attention to detail can save you a huge headache down the road.

Nailing the Details: How to Avoid Data Entry Errors

When you're entering your bank information, precision is everything. Transposing just two numbers in your account or using a nickname instead of your full legal name can be enough for an automated payroll system to reject the whole thing.

Here are the most common slip-ups and how to sidestep them:

- Mixed-Up Numbers: The easiest way to get your routing and account numbers right is to copy and paste them directly from your online banking portal. This one move eliminates the risk of a typo.

- Name and Address Discrepancies: The name and address you use must match your bank statement exactly. Don't use "Mike" if your account says "Michael," and make sure you haven't moved recently without updating your bank first.

- The Wrong Routing Number: This one trips people up all the time. Many banks use different routing numbers for wire transfers than they do for electronic payments. Always grab the number specifically labeled for ACH or direct deposit.

A voided check is really just a data verification tool. If the information on that check doesn't perfectly mirror what's in your bank's system, it can't do its one job. The result is a completely avoidable delay.

Think of it like a digital key. If even one groove is off, the lock won't turn.

What to Do If Your Voided Check Is Questioned

So, you’ve double-checked everything, but your new employer or utility company is hesitant to accept your digitally created check. This is pretty rare, but it helps to know what to say if it happens. The goal is to calmly and confidently explain why it's valid.

If an HR manager seems unsure, here’s what you can tell them:

- It Has All the Necessary Info: Point out that the document contains the exact same verified data as a paper check: your full name, address, and the crucial routing and account numbers.

- It Was Created Securely: Mention that the tool uses bank-level encryption and doesn't permanently store your financial details, which actually makes it a very safe way to share your information.

- It's a Modern Standard: Gently remind them that online voided checks are a widely accepted alternative, especially since millions of people no longer have physical checkbooks.

Usually, a polite and clear explanation is all it takes to resolve any confusion. One last tip: if you're waiting for an email with your check, don't forget to look in your spam or junk folder. Sometimes overzealous email filters hide it there.

More Than Just Payroll: Versatile Uses for Your Online Check

Most people first hunt down a voided check when starting a new job. It’s the standard way to set up direct deposit, and for good reason. But that’s just scratching the surface of what this simple document can do for you.

Think of it as the universal key to your bank account—at least for automated transactions. Anytime a business needs to pull money from or push money into your account, a voided check gives them the verified, error-free instructions they need to make it happen smoothly.

Setting Up Automatic Payments

Let's be honest, who enjoys manually paying bills? Whether it's rent, a mortgage, or a car payment, setting up automatic withdrawals can save you from late fees and headaches. Landlords and lenders often ask for a voided check to get this started, ensuring they pull from the right account every single time.

This same principle works wonders for all sorts of recurring household expenses:

- Utility Bills: Get your electricity, gas, and water bills on autopay.

- Loan Payments: Perfect for handling car loans, student loans, or personal loans.

- Subscriptions: Link your bank account for things like your gym membership or streaming services.

Using an online voided check for these setups creates a secure, reliable link. It’s the ultimate “set it and forget it” strategy for managing your essential bills.

Funding and Financial Management

Beyond just paying out, a voided check is your go-to for moving money between financial institutions. For instance, when you're ready to start investing and open a brokerage account, you’ll likely need to provide one to authorize the initial ACH transfers from your checking account.

This comes in handy in a lot of other financial situations, too.

- Funding Investment Accounts: Seamlessly transfer funds to your IRA, 401(k), or other investment vehicles.

- Securing Small Business Loans: Lenders often need a voided check from your business account to deposit loan funds and schedule repayments.

- Receiving Tax Refunds: Give a voided check to your accountant or input the details into your tax software. This tells the IRS exactly where to send your refund, which is far faster than waiting for a paper check in the mail.

In all these scenarios, your online voided check acts like a secure digital handshake. It confirms you own the account and provides the precise details needed for the transaction, preventing frustrating delays or bounced payments.

At the end of the day, being able to generate a voided check instantly gives you the power to manage your finances without ever touching a physical checkbook. It's a modern fix for a timeless financial task.

Got Questions About Online Voided Checks? We Have Answers.

It's smart to have a few questions when you're creating a financial document online. Let’s clear up some of the most common ones about validity, security, and finding your bank info so you can move forward with confidence.

Is an Online Voided Check Actually Legit?

Absolutely. A voided check you create with a reputable online service is 100% legally valid. Think about what a voided check really is: it’s just a standardized way to share your account details for verification.

Employers, government agencies like the IRS, and financial institutions all accept them because they contain the exact same critical information as a paper check—your name, address, routing number, and account number. As long as that information is accurate, the digital format is perfectly acceptable for setting up direct deposits or automatic payments.

How Do You Keep My Banking Information Safe?

This is the most important question, and the answer should be non-negotiable. Top-tier online check generators treat your security like a bank would.

Here’s what you should expect as a bare minimum:

- Bank-Level Encryption: Look for 256-bit SSL encryption. This scrambles your data as it travels, making it unreadable to anyone else.

- A "No-Storage" Promise: This is the big one. The best services have a strict policy of permanently deleting your financial details the second your check is generated. Your data isn't stored, so it can't be breached.

- Trusted Payment Processing: Any fees should be handled by secure, well-known gateways like Stripe. This means the check service itself never even sees your credit card number.

Honestly, using a service with a no-storage policy is often much safer than emailing a photo of a check. That picture can sit unencrypted in your sent folder—and the recipient's inbox—forever.

What if I Don't Have a Checkbook? Where Are My Routing and Account Numbers?

No checkbook? No problem. You’ve got a few easy places to look, straight from your bank.

Your best bet is to log into your bank's online portal or fire up their mobile app. You'll usually find your routing and account numbers under a section like "Account Details," "Information," or sometimes "Direct Deposit Info." They’re also printed right on your monthly bank statements.

Here’s a pro tip: Banks sometimes have different routing numbers for different purposes. Always grab the one labeled for "ACH" or "Electronic" transfers. Using the number for wire transfers is a common mistake that will cause the setup to fail.

Oops, I Typed Something Wrong. Now What?

It happens. The good news is that it’s an easy fix. Any decent online generator will give you a preview of the check before you finalize it. This is your chance to give everything a final once-over.

If you still miss something and only notice the mistake after you've downloaded the check, a quality service will let you edit the details and regenerate it for free, at least for a short period. This saves you the headache of starting from scratch or paying a second time.

Ready to get it done? With VoidedCheck.org, you can create a secure and professional voided check in less than a minute. It's the fastest way to get your direct deposit or automatic payments set up. Generate your voided check with VoidedCheck.org.

Related Articles

Generate Check Online: Create a Check in Seconds (generate check online)

Need to generate check online? Learn a fast, secure way to create a check for direct deposit or bill pay with our step-by-step guide.

How to create voided check online Instantly

Learn how to create voided check online for direct deposits or ACH payments. Our secure, step-by-step guide makes it fast and easy.

A Practical example of voided check: how to void and set up payments

Looking for an example of voided check? This step-by-step guide shows how to void a check correctly and offers safe, modern direct deposit alternatives.