Over 10,000 checks generated

Voided Check Generator

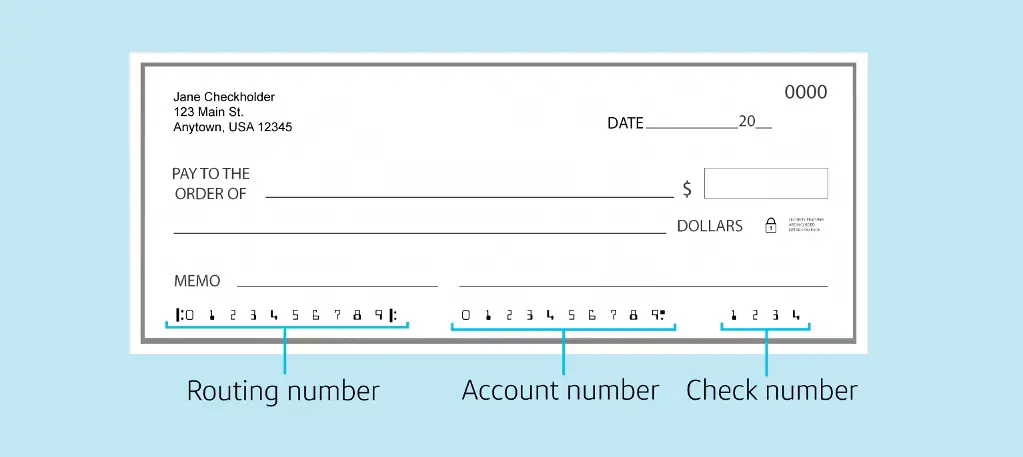

Where to Find Your Numbers

Your routing and account numbers are printed at the bottom of every check in a special MICR font. Here's exactly where to find them:

Routing Number

The 9-digit number that identifies your bank. Every check from the same bank has the same routing number.

Account Number

Your unique account number (up to 17 digits) that identifies your specific checking account at the bank.

Quick Tip

Don't have a physical check? You can also find these numbers in your online banking portal, mobile banking app, or by calling your bank. The routing number is always 9 digits, while your account number can be anywhere from 5 to 17 digits long.

How Our Voided Check Generator Works

Creating a voided check online has never been easier. Our generator uses verified US Federal Reserve banking data to ensure your check includes the correct routing number and formatting. Here's what makes our voided check generator different:

Instant Generation

Enter your banking information and receive your voided check via email in 60 seconds or less. No waiting, no appointments, no hassle.

Bank-Verified Data

Our voided check generator connects to federal banking databases to validate routing numbers and ensure accuracy. This means fewer errors and faster approval when you submit your check.

Professional Format

Every voided check created through our generator meets the formatting standards used by major payroll processors, HR departments, and financial institutions across the country.

Secure Processing

Your banking information is encrypted during generation and automatically deleted within 24 hours. We never store your account details permanently.

When You Need a Voided Check Generator

Most people search for a voided check generator when they need to set up direct deposit but don't have paper checks available. Our generator solves this problem instantly. Common situations include:

Starting a new job and your employer requires a voided check for payroll setup. HR departments typically need this within your first week, and our generator delivers it immediately.

Setting up automatic bill payments for your mortgage, rent, or utilities. Payment processors need your banking information in the exact format that a voided check provides.

Linking investment accounts or setting up recurring transfers between banks. Financial institutions often require a voided check to verify account ownership before processing transactions.

Receiving tax refunds via direct deposit from the IRS or state agencies. A voided check speeds up the refund process by providing accurate banking details.

Why Use an Online Voided Check Generator

Traditional methods of getting a voided check can be time-consuming and expensive. Here's why thousands of people choose our voided check generator instead:

Save Time

Visiting a bank branch can take an hour or more when you factor in travel time and waiting. Our voided check generator works instantly from any device with internet access.

Avoid Unnecessary Costs

Banks often charge $20 to $40 for a book of checks when you only need one voided check. Our generator gives you exactly what you need without the waste.

No Account Minimums

Some banks require you to maintain minimum balances or pay monthly fees to order checks. Our voided check generator has no such requirements.

Works With Any Bank

Our generator supports over 4,300 US banks and credit unions. Whether you bank with a major institution like Chase or Wells Fargo, or a small local credit union, our system works with your account.

What You'll Receive

When you use our voided check generator, you get a professionally formatted file that includes:

- Your name and address as it appears on your bank account

- Your bank's routing number (validated against federal banking records)

- Your account number in the correct position

- The word "VOID" prominently displayed to prevent fraudulent use

- Standard MICR formatting that matches traditional printed checks

The voided check you receive from our generator is accepted by the same institutions that accept traditional paper voided checks. We've designed our system to match the exact specifications used by professional check printing companies.

VoidedCheck.org vs. Traditional Methods

Save time and hassle with our instant digital solution

Bank Visit

- ✗60+ minute wait time

- ✗Limited branch hours

- ✗Travel required

- ✗May require appointment

Order Checkbook

- ✗5-10 day shipping

- ✗Pay for entire checkbook

- ✗Waste unused checks

- ✗Storage clutter

VoidedCheck.org

- ✓60 second generation

- ✓Available 24/7

- ✓Instant digital delivery

- ✓Pay only for what you need