Create a Void Check Online Instantly and Securely

Even with digital wallets and instant transfers, the idea of a voided check might seem like a relic from another era. But here's a little secret from the financial world: creating a void check online is still one of the best and most secure ways to verify your bank account details. It's the go-to method for setting up important things like your paycheck's direct deposit or automatic bill payments, and it's a fantastic way to prevent some seriously frustrating (and costly) mistakes.

Why a Voided Check Still Matters in Banking Today

So, why hasn't this simple document been completely replaced? It boils down to one powerful concept: undeniable proof.

When you manually type in your routing and account numbers for a new job or a bill payment, it's incredibly easy to make a mistake. One wrong digit is all it takes to send your hard-earned money into the wrong account or cause a crucial payment, like your mortgage, to bounce. A voided check completely sidesteps that risk.

Think of it as an official snapshot of your account's identity. It confirms your name, address, routing number, and account number all in one neat package that payroll departments and other companies know they can trust.

The Foundation of Automated Payments

As we've all moved toward electronic payments, the need for rock-solid account verification has only grown. In the U.S. alone, over 90% of workers get their paychecks via direct deposit. That system moves an incredible $7.6 trillion every year, and it all hinges on the flawless setup of ACH (Automated Clearing House) transfers.

This is why an estimated 80% of new hires are asked for a voided check. It’s a practice that HR departments have relied on since the 1990s to make sure paychecks land where they're supposed to, without any delays. You can find more about the history of direct deposit on artsyltech.com.

A voided check isn't just a piece of paper; it's a verification tool that builds trust between you, your employer, and your bank. It’s the simplest way to say, "Yes, this is my account, and these are the correct details."

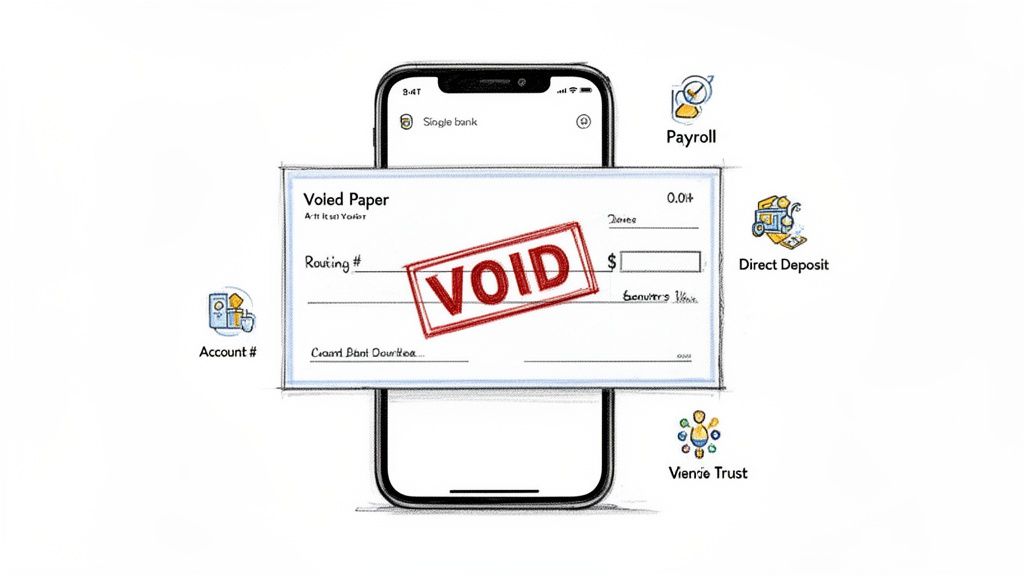

When You Might Need a Voided Check

You'd be surprised how often this little document comes in handy. It’s not something you’ll need every day, but when you do, it’s usually for something important.

This table breaks down the common scenarios requiring a voided check, helping you quickly see if this is the right solution for your situation.

| Use Case | Why It's Needed | Who Typically Asks For It |

|---|---|---|

| Setting Up Direct Deposit | To ensure your paycheck is sent to the correct bank account without any typos. | HR or Payroll Departments at your new job. |

| Arranging Automatic Bill Pay | To establish a secure link for recurring ACH withdrawals for monthly bills. | Utility companies, landlords, mortgage lenders, and loan providers. |

| Linking Financial Accounts | To verify your primary checking account when connecting it to another financial service. | Brokerage firms, investment platforms, and online high-yield savings accounts. |

Having a voided check (or a digital equivalent) ready can make these processes much smoother, saving you time and preventing headaches down the road.

What You'll Need to Create Your Voided Check Online

Before you jump in and start making a voided check, you’ll need to have a few key details ready. Think of it as gathering your ingredients before you start cooking—it makes the whole process smoother and ensures the final result is perfect. Getting these pieces of information right the first time is the single most important thing you can do to make sure your void check online works without a hitch.

The two non-negotiables are your bank's routing number and your specific account number. These numbers are like a unique address for your money, telling payroll departments or billing companies exactly where to send or pull funds. If you don't have them memorized (most of us don't!), don't worry. They're easy to track down.

Finding Your Account and Routing Numbers

The quickest way to find these numbers is usually right in your pocket. Just log into your mobile banking app or your bank's website. The exact spot can differ from bank to bank, but you're typically looking for a section called "Account Details," "Account Info," or something similar.

For example, here's where you can often find them in a few popular banking apps:

- Chase: Once you're in your checking account view, just tap on "Show details." You'll see both numbers pop up.

- Bank of America: After selecting your account, look for an "Information & Services" tab.

- Wells Fargo: Tap on your checking account, and there should be a "Routing & Details" option with everything you need.

Still have a paper statement lying around? Great. You’ll almost always find both numbers printed right at the top or bottom of the first page.

A quick tip from experience: always double-check these numbers. The routing number points to your bank, but the account number is yours and yours alone. One wrong digit can send your paycheck into the void or cause an automatic payment to fail, creating a headache you don't need.

Making Sure Your Personal Details Are Spot-On

Next up are your name and address. This might seem obvious, but precision is key. You need to use the exact name and address that your bank has on file—no nicknames, abbreviations, or old addresses. The best way to confirm this is to look at a recent bank statement and copy it precisely.

This is where a dedicated service really helps. For example, a platform like VoidedCheck.org provides simple, clear fields for you to enter this info, guiding you so nothing gets missed.

A good tool won't just take your word for it, either. Behind the scenes, it should cross-reference the routing number you enter with official Federal Reserve data. This confirms the bank's name and location, adding a crucial layer of verification that ensures the final document looks professional and, more importantly, is completely accurate.

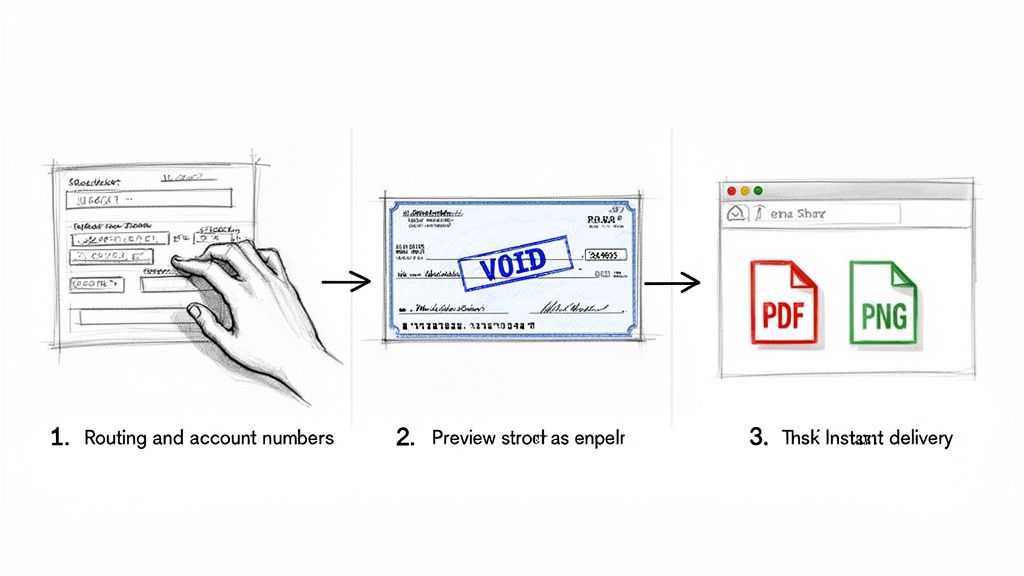

Get Your Voided Check in Under a Minute

Alright, you’ve got your account details handy. Now for the easy part. Creating a void check online is surprisingly fast—we're talking less than 60 seconds from start to finish. I'll walk you through how it works using a real-world example so you can see just how straightforward it is.

We’ll use a purpose-built tool like the one at VoidedCheck.org. These platforms are designed to do one thing and do it well: get you a valid, professional-looking document without any headaches.

Plugging in Your Banking Information

First things first, you'll need to enter your core banking details. You’ll see simple, clearly marked fields for your routing and account numbers.

As you type in your routing number, a good online tool will instantly check it against Federal Reserve data and pop up your bank's name. It's a nice little confidence boost, letting you know you’re on the right track from the get-go.

Next up is your account number. This is where you want to be extra careful. Take a moment to double-check every single digit, as this number is the unique identifier for your specific account.

Adding Your Personal Details

With the numbers locked in, you’ll add your name and address. This part is absolutely critical—the information here must perfectly match what’s on your bank’s official records.

- Your Name: Use your full legal name, exactly as it appears on your bank statements. No nicknames or shortened versions here.

- Your Address: Pop in the complete mailing address tied to your account. That means street, city, state, and zip code.

Getting this right is key to avoiding delays. Mismatched information is one of the most common reasons direct deposits or automatic payments get kicked back.

The Final Preview and Download

Before anything is set in stone, you’ll get a preview of the finished check. This is your moment to be the final inspector. Give it a good look-over. Is your name spelled correctly? Are the numbers right? Is the address accurate? Catching a small typo here will save you a world of frustration later on.

Once you give it the green light, the magic happens.

In an instant, a professionally formatted voided check lands right in your email inbox. It usually comes in both PDF (great for printing) and PNG (perfect for digital sharing) formats.

This means you don't have to wait around. You can immediately forward the file to your HR department or upload it to a company's payment portal. With a tool like the VoidedCheck.org generator, you'll have the document you need before you can even close the browser tab.

As a final tip, look for services that provide a Universal Acceptance Guarantee. This is a huge plus. It’s their promise that the check you just made is formatted to meet the standards used by payroll processors, banks, and HR departments everywhere. Some platforms even let you make corrections and regenerate the check after the fact, which is a lifesaver if you spot a mistake.

Keeping Your Financial Information Safe and Secure

Let's be honest, handing over banking details online can feel a little nerve-wracking. Even for something as simple as a voided check, you want to know your information is safe. That’s why any legitimate service for creating a void check online absolutely must put security first, building in several layers of protection from the moment you visit their website.

The first thing to look for is 256-bit SSL encryption. Think of it as a private, encrypted tunnel connecting your computer to the website. It instantly scrambles every piece of data you type—your name, address, and those all-important account numbers—making it completely useless to anyone who might try to snoop. This is the same high-level encryption your own bank uses, so it's a non-negotiable standard.

Your Data Is Never Stored

Here’s the most important security promise a service can make: a strict, no-exceptions policy against storing your personal data. Once your voided check is created and you've received it, a trustworthy platform should permanently wipe all the information you entered. This is a huge deal. It means there’s simply no database of customer account details for hackers to ever get their hands on.

This commitment is what gives you real peace of mind. For a full breakdown of how we handle this, you can read our detailed privacy policy at https://voidedcheck.org/privacy, which clearly states our commitment to never holding onto your financial information.

Another key detail is how payments are handled. Top-tier platforms don’t process your credit card themselves; they partner with trusted giants like Stripe, which securely manage millions of transactions every day. The check generator never even sees your payment details. It’s all handled by a world-class system that’s built for this exact purpose.

Designed for Universal Acceptance

Strong security is one half of the coin; the other is making sure the check actually works. A digitally generated voided check has to be built from the ground up to meet the standards that payroll departments, HR managers, and banks expect. It must have all the essential information, formatted perfectly, so it can be used for verification just like a paper check you’d pull from your checkbook.

A "Universal Acceptance Guarantee" isn't just a catchy phrase. It's a promise that the document you get is properly formatted for ACH processing and will be accepted by any U.S.-based institution for setting up direct deposits or automatic payments.

Voided checks themselves are a tried-and-true tool for preventing fraud. The Financial Crimes Enforcement Network (FinCEN) found that a staggering 43% of suspicious activity reports in one analysis were tied to check fraud. By clearly marking a check as "VOID," you make it impossible to use for payment while still providing the account details needed for verification. It’s a simple but effective security measure.

Practical Uses and Pro Tips for Your Voided Check

So, you've just generated a void check online in a matter of seconds. Great. But what do you actually do with it? Think of this simple digital document as your financial handshake—it's the standard, trusted way to prove your account details for some of the most important transactions you'll make.

By far, the most common reason you'll need one is for setting up direct deposit. When you start a new job, the HR department isn't just being difficult when they ask for one; they need to be 100% certain your paycheck is going to the right place. A voided check removes any guesswork or typos that can happen when you're just reading numbers off a screen.

It's also your ticket to automating your financial life. Setting up automatic payments for your mortgage, rent, or car loan often requires it. Handing over a voided check to a lender or landlord is the universally accepted method for authorizing those automatic ACH withdrawals, giving both sides peace of mind.

Where This Comes in Handy

Let’s get practical. Here are a few real-world situations where having an online voided check ready to go is a lifesaver.

The Freelancer's Payday: You just landed a great new client, and they pay via direct deposit. Instead of waiting a week for a physical checkbook to arrive in the mail, you can generate a voided check right now and email it over. That simple step gets you into their payment system faster, which means you get paid on time.

The Savvy Investor: You're opening a new brokerage account to start investing. To link your bank for funding your trades, the firm will almost always ask for a voided check. It's their way of verifying the external account before they let you move money back and forth.

The Modern Renter: Your new apartment complex manages everything through an online portal. To set up recurring rent payments, you’ll need to upload proof of your bank account. This is the perfect use case for a quick PDF download of your voided check.

Even with all the digital payment apps out there, the voided check remains a key piece of the financial puzzle. It’s a testament to its reliability that nearly 14.5 billion checks are still processed annually in the U.S. This shows why a solid verification method, now provided by online generators, is still so essential. You can learn more about check regulations from the Federal Election Commission's resource page.

A Few Pro Tips I've Learned Along the Way

From years of setting these things up, I can tell you that a few seconds of extra care can save you days of headaches. Before you send that file off, run through this quick mental checklist.

Double-Check Everything

I can't stress this enough: always double-check your numbers. It’s so easy to transpose a digit in your account or routing number. That one tiny mistake can send your paycheck into limbo. Use the preview screen to give it one last, careful look before you finalize and download it.

Send It Securely

Think about how you're sharing this document. It contains sensitive information. The best practice is to use a company's secure portal for uploads. If you have to email it, make sure you're on a secure, private Wi-Fi network—not the public one at your local coffee shop.

Confirm It Arrived

A quick follow-up is your best friend. A day or two after you send the voided check, shoot a quick email or make a call to confirm they received it and that everything looks correct. This little proactive step ensures your direct deposit or bill pay gets set up smoothly, without any surprises later on.

Answering Your Top Questions About Online Voided Checks

Switching from paper checks to a digital tool can bring up a few questions, especially when it involves your banking information. It's smart to be thorough. Let's walk through the most common things people ask about creating a void check online, so you can feel completely comfortable with the process.

Is an Online Voided Check as Legit as a Paper One?

You bet it is. A digitally created voided check holds all the same essential details as a paper one ripped from your checkbook—your name, address, routing number, and account number. Remember, its only job is to verify your account information, not to be used for payment.

In my experience, because these online versions are professionally formatted and pull from validated bank data, they're accepted just about everywhere. Payroll departments, HR managers, and banks see them all the time for setting up direct deposits and automatic bill payments. It's simply the modern, more convenient version of an old-school tool.

What Happens If I Type Something Wrong?

It’s easy to mistype a number, which is why a good online service builds in a safety net. The best tools will always give you a preview of the check before you finalize it. This is your moment to be a hawk and check every single detail.

But hey, mistakes still happen. That's where a feature like post-purchase editing becomes a real lifesaver. If you find a typo in your name, address, or account numbers after the fact, you can simply go back, fix it, and regenerate a new, correct check. This avoids the headache and delays that come from submitting bad information.

How Fast Will I Get My Voided Check?

This is where online tools really shine. The whole process, from start to finish, typically takes less than 60 seconds.

There's no waiting around. The moment you finalize the check, it lands in your email inbox. You’ll usually get it in two handy formats:

- A high-quality PDF, which is perfect for printing or uploading directly to an employer’s online portal.

- A PNG image file, which is super easy to attach to an email.

You can download it, print it, or forward it on immediately.

Can I Use This for My Business Account?

Absolutely. Any solid online voided check generator will handle both personal and business accounts without a problem. Just make sure you have the correct routing and account numbers, along with the official business name and address tied to the account.

I see this all the time with small business owners and freelancers. It's a game-changer for setting up ACH payments with new clients, getting vendor accounts established, or just making sure your own business-to-business payments run smoothly.

Ready to create a professional voided check in under a minute? With VoidedCheck.org, you get a fast, secure, and widely accepted document without needing a physical checkbook. Give it a try now at https://voidedcheck.org.

Related Articles

Generate Check Online: Create a Check in Seconds (generate check online)

Need to generate check online? Learn a fast, secure way to create a check for direct deposit or bill pay with our step-by-step guide.

How to create voided check online Instantly

Learn how to create voided check online for direct deposits or ACH payments. Our secure, step-by-step guide makes it fast and easy.

A Practical example of voided check: how to void and set up payments

Looking for an example of voided check? This step-by-step guide shows how to void a check correctly and offers safe, modern direct deposit alternatives.