Choosing the Best Payroll Software for Small Business

What's the best payroll software for a small business? The honest answer is: it depends. It comes down to your company's size, your industry, and where you're headed. While a platform like Gusto gets rave reviews for its ease of use and QuickBooks Payroll is a no-brainer for its accounting integration, the right choice is the one that actually fits your day-to-day operations—whether that's paying a team of contractors or untangling multi-state tax laws.

How to Select the Right Payroll Software

Picking a payroll solution is a foundational decision for any small business. Ditching manual spreadsheets for dedicated software isn't just a nice-to-have; it's essential for saving time, sidestepping costly errors, and staying on the right side of constantly shifting tax rules. The right platform puts core tasks on autopilot, giving you back the time to actually run your business.

The market for these tools is massive for a reason. In 2024, the global payroll software market hit $8.4 billion, with big names like ADP, Paycom, and Workday dominating the space. This isn't just a tech trend—it shows how indispensable these systems have become for businesses trying to manage complex payments and stay compliant.

Aligning Software with Your Business Needs

Before you start comparing flashy features, you need to get crystal clear on what your business actually requires. The perfect system for a ten-person remote tech startup will likely be a terrible fit for a local restaurant dealing with tipped wages.

Start by thinking through these key areas:

- Business Size and Scalability: How many people are on your payroll right now, and what does that look like in a year? You need a system that can grow with you, not one you'll outgrow in six months, forcing a painful switch.

- Industry-Specific Requirements: Some fields have unique payroll headaches. Think construction with its certified payroll reports or restaurants with complex tip calculations. Make sure any software you consider can handle the nitty-gritty of your industry.

- Employee Type: Are you paying W-2 employees, 1099 contractors, or a mix of both? A good platform makes it simple to pay everyone correctly and generate the right tax forms at year-end without any fuss.

One of the first hurdles you'll face is getting everyone's bank details for direct deposit. Modern tools can help; our guide on how to create a digital voided check shows how new hires can securely share their information, even if they don't have a physical checkbook.

This guide will give you a straightforward framework for evaluating your options based on these real-world needs, so you can find a tool that makes your life easier from day one.

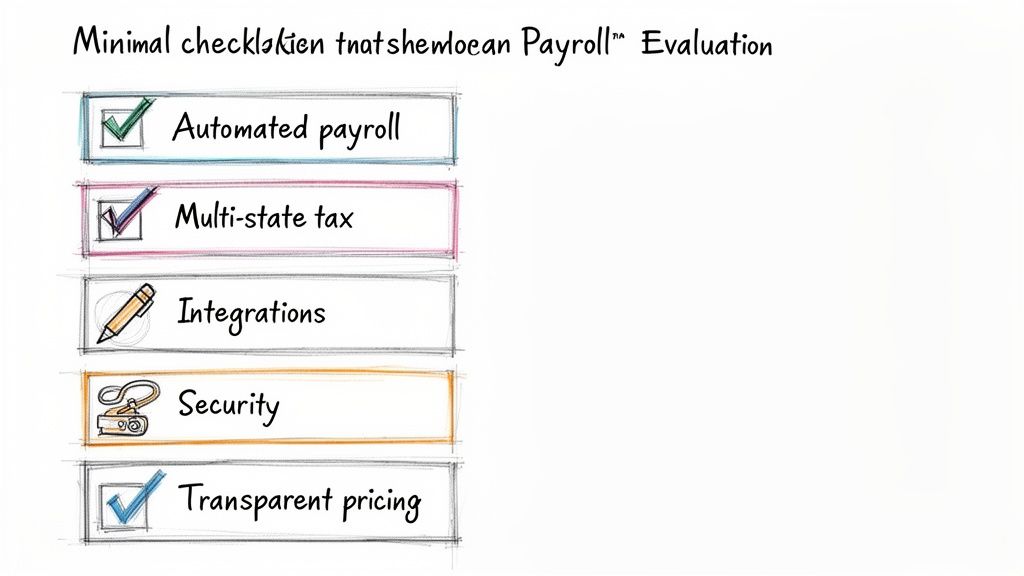

How to Evaluate Payroll Software: A Checklist for Small Businesses

Choosing the right payroll software feels like a huge decision, because it is. To get it right, you need to think beyond a simple feature list and really dig into what makes a platform work for your business. This isn't just about paying people; it's about building an operational backbone that can support you as you grow.

Let's walk through the essential criteria I use when advising businesses, so you can make a choice with confidence.

Core Payroll and Tax Compliance

First and foremost, the software has to nail the basics: paying your team accurately and on time. But where the real value comes in is how it handles the tangled mess of tax compliance that gives so many entrepreneurs headaches.

Your evaluation should center on these non-negotiable features:

- Automated Payroll Runs: Can you set it and forget it for your salaried staff? How easy is it to process hourly wages? Good software should take this repetitive work off your plate, which immediately cuts down on the chance of a costly typo.

- Multi-State Tax Filing: This is a deal-breaker if you have remote employees. The platform must automatically calculate, withhold, and file payroll taxes for every single state your team works in. Trying to manage this manually is a recipe for disaster.

- Year-End Reporting: Look for software that automatically generates and files your W-2s and 1099s. This one feature can turn a frantic, stressful tax season into a complete non-event.

These compliance tools are your best defense against expensive penalties. The IRS doesn't mess around with filing deadlines or accuracy, making automated tax management a must-have, not a nice-to-have.

A platform with solid compliance tools doesn't just lighten your workload—it directly manages your financial risk. While 92% of business leaders agree payroll is strategically vital, a staggering 89% admit their current systems aren't cutting it, often because of compliance gaps.

Integrations and Employee Access

Payroll doesn't exist in a bubble. It's connected to your accounting, time tracking, and HR functions. A platform that can talk to the other tools you already use—like QuickBooks or Xero—is a game-changer.

When your payroll system automatically syncs with your accounting software, for example, your labor costs are always up to date. No more manual data entry or tedious reconciliation. It just works.

Just as important is the employee self-service portal. This is more than a convenience; it's about empowering your team and giving them ownership.

A good portal lets your employees:

- See and download their own pay stubs whenever they want.

- Grab their W-2s or 1099s at tax time without having to ask.

- Update their address or bank info for direct deposit on their own.

This simple feature drastically cuts down on the administrative back-and-forth, freeing you up to focus on more important things. It’s a win for everyone.

Pricing, Security, and Support

Finally, let's get practical. You need to look at the money, the security, and the help you’ll get when things go wrong.

Pricing models can be tricky, so dig deeper than the advertised monthly fee. You need to understand the total cost of ownership. Ask about hidden fees for things like initial setup, running an off-cycle payroll, or filing those year-end tax forms.

Security is absolutely critical. You're handling your team's most sensitive financial information. Make sure any provider you're considering uses top-tier security measures, like 256-bit SSL encryption, to keep that data locked down tight.

And never, ever underestimate the value of good customer support. When you have a payroll problem, you need help now, not tomorrow. Check for providers that offer real, responsive support through phone, email, or live chat, especially when you're on a deadline.

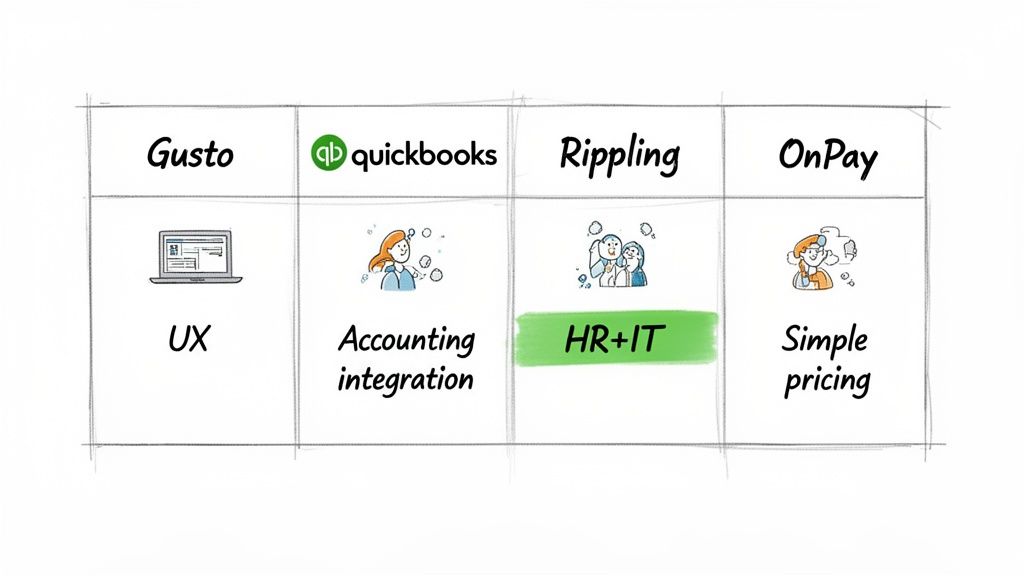

Comparing the Top Small Business Payroll Platforms

Now that we've laid out the essential criteria, let's see how the leading payroll platforms actually perform in the wild. Each of these solutions has a unique personality and excels in different areas. This isn't just a feature checklist; it's a head-to-head analysis to show you exactly where each platform shines.

The goal here isn't to name one "winner." It's to give you a clear, balanced look at the top contenders so you can find the right fit for your business. We'll dive into Gusto, QuickBooks Payroll, Rippling, and OnPay, breaking down what makes them tick and who they’re truly built for.

Choosing the right platform is more important than ever. The global payroll software market is expected to hit $11.1 billion by 2029, a huge leap from $8.4 billion in 2024. According to IDC's comprehensive forecast, this growth is all about the demand for cloud-based, smart solutions that can navigate tricky compliance issues—proving just how critical a scalable tool is for small businesses today.

Gusto: The User Experience Champion

Gusto won over the small business world by focusing on one thing: making payroll simple and, dare I say, enjoyable. It’s a favorite among startups and modern businesses because the platform just feels good to use. The interface is clean and intuitive, designed for owners who are experts in their field, not payroll administration.

Beyond automating payroll and tax filings, Gusto’s real magic is how it handles the entire employee journey. It weaves benefits, onboarding, and HR tools directly into the payroll process, creating one seamless system from an employee's first day.

This all-in-one approach is perfect for businesses that want a unified system without the sticker shock of a full-blown Human Capital Management (HCM) platform. A new hire can onboard themselves, pick their benefits, and set up direct deposit without ever leaving the platform.

Key Differentiator: Gusto is built around the employee. Its self-service portal is more than just a place for pay stubs; it’s a financial wellness hub with tools like Gusto Wallet, giving employees early access to their earned wages.

Gusto is a fantastic fit for tech-savvy small businesses, creative agencies, and any company that puts a high value on employee experience. It also handles multi-state payroll effortlessly, making it a go-to for remote teams. The main trade-off? If you have highly specialized needs like certified payroll for construction, you might find it a bit too general.

QuickBooks Payroll: The Accounting Powerhouse

For the millions of businesses already running on QuickBooks Online, adopting QuickBooks Payroll is the most natural next step. Its killer feature is its deep, native integration with the QuickBooks accounting ecosystem. There's no substitute for that.

This connection means every payroll run instantly updates your general ledger. Labor costs, taxes, and deductions are recorded automatically and accurately, which saves a ton of time on manual data entry and kills reconciliation headaches before they start.

QuickBooks Payroll comes in a few different flavors. You can start with a basic plan for automated payroll and tax filing, then scale up to premium options that add HR support, time tracking, and even same-day direct deposit.

This platform is the undisputed choice for any business deeply invested in the Intuit world. If your bookkeeper and accountant live in QuickBooks, the efficiency you’ll gain is a no-brainer.

But what if you don't use QuickBooks? The value proposition gets a little weaker. The interface feels more functional than modern compared to its slicker competitors, and customer support has a reputation for being hit-or-miss—a real problem when you have a time-sensitive payroll question.

Rippling: The Scalable Workforce Platform

Rippling isn't just payroll software; it's a full-on "Workforce Management Platform." It’s engineered differently from the ground up to unify HR, IT, and Finance into a single system, making it an absolute beast for businesses planning to scale.

With Rippling, payroll is just one piece of a much bigger puzzle. You can manage onboarding, benefits, company laptops, and software access all from one place. Imagine hiring someone and, with one click, triggering a workflow that adds them to payroll, orders their computer, and creates their Slack and Google Workspace accounts. That’s Rippling.

This level of automation is something most payroll-focused platforms just can't touch. It’s incredibly customizable, letting you build out workflows and reports that match your exact operational needs.

Rippling's Edge: It serves as the single source of truth for all employee data. This eliminates the data silos that cause so many administrative headaches, ensuring everything from payroll to IT is perfectly in sync.

Rippling is the top pick for fast-growing tech companies and mid-sized businesses that need to manage the entire employee lifecycle, not just their pay. The downside? It can be complex and costly. For a small shop with simple needs, it's likely overkill. Its à la carte pricing is flexible but can make it hard to nail down the final cost without getting a formal quote.

OnPay: The All-Inclusive Value Leader

OnPay’s approach is refreshingly simple: one plan, one price, and you get everything. There are no confusing tiers or expensive add-ons. Every customer gets the full feature set right out of the box.

This all-in-one package includes unlimited payroll runs for W-2 employees and 1099 contractors, tax filings in all 50 states, and all year-end forms. It also throws in valuable HR tools like offer letter templates, digital onboarding checklists, and PTO tracking at no extra charge.

A huge advantage for OnPay is its knack for handling industry-specific payroll. It has built-in support for the unique needs of restaurants, farms, and non-profits, including specialized tax forms and calculations that many competitors don't offer.

OnPay is an amazing value for small businesses that want powerful payroll and HR tools without a complicated price tag. Its ability to seamlessly handle a mixed workforce of employees and contractors across different states makes it incredibly versatile. Users also consistently praise their expert customer support.

While it’s packed with features for the price, it doesn’t quite have the polished user experience of Gusto or the heavy-duty automation of Rippling. And if you need deep integrations beyond QuickBooks and Xero, you might find its app ecosystem a bit more limited.

To help you visualize how these platforms compare on key functions, here's a quick summary.

Payroll Software Feature Comparison at a Glance

This table breaks down some of the most important features to give you a quick snapshot of where each provider stands.

| Feature | Gusto | QuickBooks Payroll | Rippling | OnPay |

|---|---|---|---|---|

| Best For | User Experience & Startups | Existing QuickBooks Users | Scalability & Automation | All-in-One Value & Niche Industries |

| Core Payroll | Full-service, multi-state | Full-service, multi-state | Full-service, global capabilities | Full-service, multi-state |

| HR Tools | Onboarding, benefits, time tracking | HR support, time tracking (premium) | Full HRIS, PEO, benefits admin | Onboarding, PTO, offer letters |

| Standout Feature | Employee-centric financial tools | Seamless accounting integration | Unified HR, IT, and Finance | One simple, all-inclusive plan |

| Accounting Integrations | QuickBooks, Xero, FreshBooks & more | Native to QuickBooks | QuickBooks, Xero, NetSuite | QuickBooks, Xero |

| Pricing Model | Tiered (per employee/month) | Tiered (per employee/month) | Modular & custom (starts at $8/mo) | Flat-rate (base fee + per employee/month) |

This at-a-glance view should make it easier to see the core strengths and narrow down which platforms align with your most critical needs.

Situational Recommendations for Different Business Needs

Choosing the best payroll software for a small business isn’t about finding one perfect platform. It’s about matching a tool’s strengths to the real-world demands of your company. A feature that’s a lifesaver for a remote tech startup might be totally irrelevant to a local coffee shop.

This is where we move past feature lists and get into practical advice. By looking at a few common business scenarios, you can see which platform truly aligns with your day-to-day challenges and make a decision that fits like a glove.

The Solopreneur or Freelancer with Contractors

If you're a one-person shop or a small agency that relies on 1099 contractors, your payroll needs are simple but non-negotiable. You just need a dead-simple, affordable way to pay people on time, keep track of payments, and generate 1099-NEC forms at year-end without any headaches. Complexity is your enemy here.

For this setup, QuickBooks Payroll is a natural fit, especially if you’re already in the QuickBooks ecosystem for your accounting. Their contractor-only plan is budget-friendly and syncs flawlessly with your books, which makes financial management a breeze. The ability to handle direct deposits and automate tax forms is a huge time-saver.

Another excellent option is Gusto. Its contractor-only plan is known for its clean, modern interface and is incredibly easy to use. If you think you might hire W-2 employees in the future, Gusto gives you a great starting point with a simple path to upgrade.

The Growing Startup Hiring Its First Employees

The moment a startup hires its first W-2 employee, the game completely changes. Suddenly, you're on the hook for tax withholdings, benefits administration, and a labyrinth of state-specific rules. You need a platform that not only nails payroll but also makes the entire employee onboarding process smooth and professional.

Gusto was practically built for this exact moment. Its real power is in its all-in-one approach to payroll, benefits, and HR. You can manage everything from sending offer letters and onboarding new hires digitally to letting them self-enroll in health insurance, all within one system. It creates an incredible first impression for your new team.

You don't need to be a payroll expert to get it right with Gusto. Its intuitive design is a massive advantage for founders who are already wearing a dozen other hats and just need technology to work without constant hand-holding.

The Restaurant or Cafe with Tipped Employees

Restaurants, cafes, and bars have payroll headaches that most businesses never encounter. You’re dealing with blended overtime rates, credit card tip distribution, and filing specialized forms like Form 8027. These aren’t tasks you can afford to get wrong.

This is where OnPay really shines. It has specific features built for the hospitality industry, including automated tip reporting and wage calculations that properly account for the tip credit. This functionality is crucial for staying compliant with the Fair Labor Standards Act (FLSA), a common tripwire for restaurant owners.

While other platforms can technically handle tips, OnPay’s focused tools eliminate the need for manual workarounds and messy spreadsheets. That alone dramatically reduces the risk of making a costly compliance mistake.

The Fully Remote Team with Multi-State Compliance

Managing a distributed workforce is becoming the new standard, but it opens a Pandora's box of payroll complexity. Every state has its own rules for income tax, unemployment insurance, and labor laws. A single mistake in one state can trigger penalties, making multi-state compliance an absolute must-have.

For any business with employees scattered across the U.S., Rippling is an incredibly robust solution. It was designed from the ground up for the challenges of a remote workforce. When you hire someone in a new state, Rippling automatically handles state tax registration and ensures the correct taxes are withheld from day one.

Gusto and OnPay also offer solid multi-state support, but Rippling’s advantage is its unified platform that goes beyond payroll into IT and device management. You can onboard a new hire, ship them a laptop, and grant them software access all from a single dashboard. For a truly distributed company, it’s the most comprehensive tool for the job.

Implementing Your New Payroll System and Direct Deposit

You've done the hard work and picked the perfect payroll software for your business. That's a huge milestone, but the real test is getting it up and running smoothly. A well-thought-out implementation is what separates a great investment from a frustrating one, ensuring your team gets paid correctly from the very first run.

It all starts with gathering the right information. Before you can process a single paycheck, you’ll need to load the system with your company's tax IDs and all the essential employee details—think W-4s for tax withholding and, critically, their bank account information for direct deposit. Getting this part right saves you from a world of headaches and payment delays down the road.

Streamlining Direct Deposit Setup

The way we handle payroll is changing fast. In fact, North America is expected to drive 40% of the global HR payroll software market's growth between 2024 and 2029. This boom is largely thanks to small businesses finally getting access to cloud-based tools that automate tasks and slash costs. If you want to dive deeper into these trends, Technavio.com has some great insights.

But even with all this new tech, one old-school requirement often throws a wrench in the works: the voided check. Many payroll systems still ask for one to set up direct deposit, which can be a real pain. It's a bottleneck, especially when you're onboarding remote employees or younger team members who might not even own a checkbook. Nobody wants their first task as a new hire to be a trip to the bank for a counter check.

Key Insight: A slick direct deposit setup isn't just a nice-to-have; it shows your company is organized and modern. When you cut out clunky, manual steps, you make a great first impression and free up your own team's time from the get-go.

Thankfully, there are digital tools designed to fix this exact problem.

The Modern Solution for Bank Verification

This is where services like VoidedCheck.org come in. They offer a simple, modern fix by letting employees generate a secure, valid voided check online in just a few seconds. No physical checkbook needed.

It’s a straightforward process that completely modernizes this little piece of the onboarding puzzle.

The platform even cross-references routing numbers with Federal Reserve data, so you know the information is accurate and ready for your HR and payroll systems. It’s a small tool that makes a big difference, keeping your entire payroll process digital from start to finish. It’s even useful for business owners who might need a voided business check for setting up payments. By embracing these kinds of solutions, you ensure your implementation is just as forward-thinking as the software you chose.

Payroll Software FAQs: Your Questions Answered

Even after you've narrowed down your choices, a few questions always seem to pop up. It's completely normal. Choosing a payroll system is a big decision, and it’s smart to get clarity on the details around cost, implementation, and some of the industry jargon.

Let’s tackle some of the most common questions small business owners ask. My goal here is to clear up any lingering confusion so you can move forward with confidence.

How Much Should I Expect to Pay for Payroll Software?

You’ll almost always see payroll software pricing broken into two pieces: a monthly base fee plus a small charge for each person you pay. A typical entry-level plan might run you $40 per month and an additional $6 per employee.

But be careful—the sticker price isn't the whole story. More feature-rich plans that include HR tools like benefits management or time tracking will cost more. The real thing to watch out for are the hidden fees. Ask vendors directly if they charge extra for critical tasks like filing year-end W-2s and 1099s, or for running payroll outside your normal schedule to pay a bonus.

Before you sign anything, get a detailed quote that reflects your exact number of employees and contractors. That's the only way to know the true cost.

Can I Switch Payroll Providers in the Middle of the Year?

Yes, you absolutely can, but it demands careful planning to prevent any tax or compliance mishaps. The single most critical task is getting all of your historical payroll data from the current year over to the new provider.

Your new system will need this information to be perfect:

- Year-to-date wages for every single employee.

- A complete record of all federal, state, and local taxes withheld.

- Details on every deduction, like health insurance premiums or retirement contributions.

A Quick Tip from Experience: While you can make a move anytime, it’s far easier to switch at the beginning of a new quarter (January 1, April 1, July 1, or October 1). This lines up perfectly with tax filing deadlines and just makes the data transfer much cleaner. Any good provider will have a team dedicated to helping you make the transition smoothly.

What's the Real Difference Between Payroll Software and a PEO?

This one boils down to a simple question: who is the legal employer? With payroll software, you are. It's a tool you own and operate to manage your payroll. You remain the sole employer of record, which means all the legal responsibility for tax filings and compliance rests on your shoulders.

A Professional Employer Organization (PEO), on the other hand, becomes a co-employer. You sign an agreement that allows the PEO to take on the legal and administrative burdens of being an employer—payroll, benefits, compliance, the works. The big draw for small businesses is getting access to top-tier health insurance and benefits at prices they could never secure on their own. The trade-off? You hand over a good deal of direct control over your HR.

Why Do I Still Need a Voided Check for Direct Deposit?

It might seem old-fashioned, but asking for a voided check is a time-tested way to verify an employee's banking information with certainty. It provides physical proof of three essential details all at once: the bank’s routing number, the employee’s account number, and the official account holder's name and address.

Think of it as a safety measure. This one simple step helps prevent frustrating and costly errors, like sending a paycheck to the wrong account. It also serves as a formal authorization document that you can keep on file, confirming you have the correct banking details directly from the source. For new hires who don't use physical checks, online tools offer a secure and instant alternative, generating a valid voided check that works with virtually every payroll system out there.

Ready to modernize your onboarding process and eliminate the hassle of physical checks? With VoidedCheck.org, your new hires can generate a secure, compliant voided check in under 60 seconds. Create a voided check now and make direct deposit setup simple for everyone.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.

What Is ACH Authorization A Simple Guide to How It Works

What is ACH authorization? This guide explains how ACH authorization works for direct deposits, bill payments, and more in easy-to-understand terms.