What Is ACH Authorization A Simple Guide to How It Works

At its heart, ACH authorization is the permission slip you give a company, allowing them to either pull money from or put money into your bank account. It’s the explicit "yes" required for electronic transfers, making things like direct deposit paychecks and automatic bill payments possible.

This agreement is the bedrock of trust that ensures your money moves exactly when and where it's supposed to.

The Role of an ACH Authorization

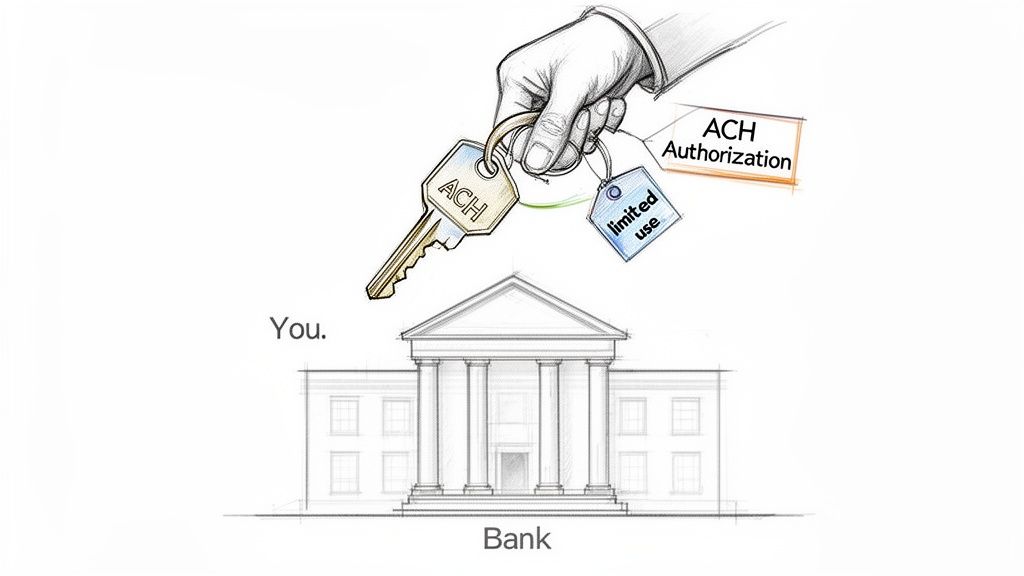

Think of your bank account like your home. You wouldn't just hand out keys to anyone; you’d only give one to a trusted person for a specific reason. An ACH authorization works the same way—it's like giving a special, limited-use key to a company you trust, like your employer or your utility provider.

This "key" doesn't grant them free rein. It comes with very clear, strict rules that you both agree on ahead of time. For instance, your employer's key only works to deposit your paycheck every other Friday. Your gym's key only works to withdraw a set membership fee on the 1st of the month. They can't do anything else.

The People Behind the Process

To make these transactions happen smoothly, a few different players work in concert. Knowing who does what helps demystify the entire process.

- You (The Receiver): As the account holder, you're in the driver's seat. You're the one granting permission and setting the rules for who gets a "key" and what it can be used for.

- The Company (The Originator): This is the business or person asking for permission to start a transaction. They could be initiating a credit (like a direct deposit) or a debit (like a bill payment).

- The ACH Network: Think of this as the secure financial superhighway connecting all the banks. It’s the central hub that makes sure payment instructions travel safely from the Originator's bank to your bank.

This authorization is the first and most critical step for any payment processed through the Automated Clearing House (ACH) network—the U.S. system that lets us move money between bank accounts without paper checks. The quarterly transaction volume, which you can explore on the Federal Reserve's website, shows just how integral this system has become.

For most of us, this looks like signing a simple form when starting a new job for direct deposit or setting up automatic rent payments. But for HR managers, small business owners, and accountants, this authorization is a vital compliance tool that prevents unauthorized withdrawals and ensures every payment is legitimate.

To make sense of it all, it helps to break down the core pieces of any authorization agreement.

Key Components of an ACH Authorization at a Glance

This table gives you a quick rundown of the non-negotiable elements you'll find in any legitimate ACH authorization form.

| Component | What It Is | Why It's Important |

|---|---|---|

| Clear & Conspicuous Terms | The agreement must be written in plain language that is easy to understand. | You need to know exactly what you're agreeing to—the amount, frequency, and purpose of the transaction. |

| Receiver's Authorization | Your explicit signature or electronic consent giving the Originator permission. | This is the legal proof that you approved the transaction, protecting both you and the business. |

| Transaction Details | Specifies whether the payment is a one-time or recurring transaction. | Avoids confusion and ensures you aren't charged unexpectedly or repeatedly for a single purchase. |

| Amount & Timing | States the exact dollar amount (or a range for variable bills) and the date(s) of the transaction. | This sets clear expectations and prevents overdrafts or surprise withdrawals from your account. |

| Revocation Instructions | Clear instructions on how you can cancel or stop the authorization at any time. | Puts you in control by guaranteeing your right to stop future payments whenever you choose. |

Ultimately, this foundational agreement is what makes so many of our modern financial interactions convenient, predictable, and secure.

How the ACH Authorization Process Actually Works

Once you’ve given a company the green light, your ACH authorization sets a well-oiled machine in motion. It's not an instant zap of money like a wire transfer. Instead, think of it as a highly organized digital courier service that runs on a strict, predictable schedule.

This system is the backbone for millions of daily payments, handling everything from your paycheck to that monthly gym membership fee. The entire operation is governed by a set of rules from Nacha (the National Automated Clearing House Association), which keeps every transaction secure, standardized, and reliable.

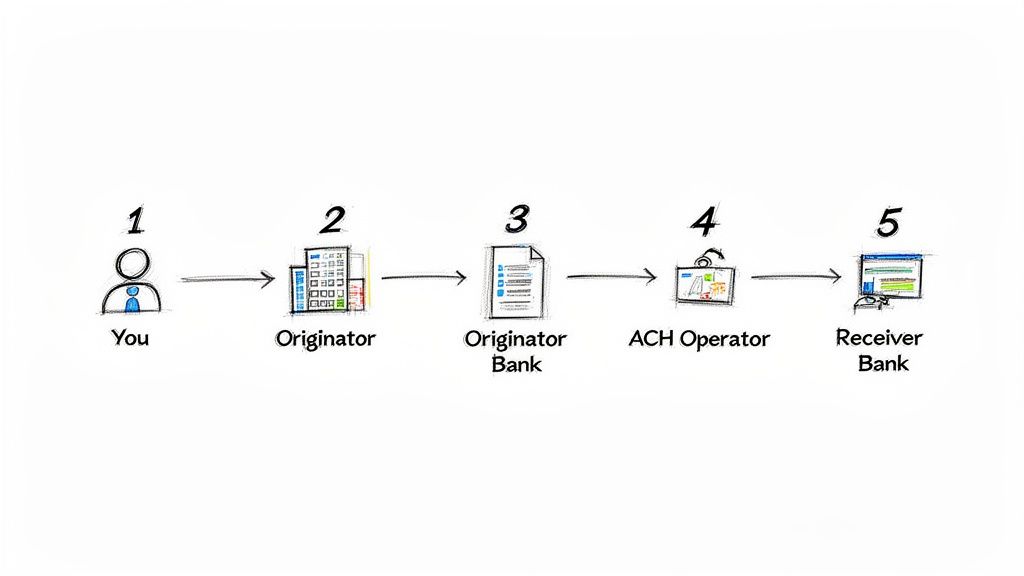

The Five Steps of an ACH Transaction

From the moment you sign the form to the money landing in the right account, the journey unfolds in five clear steps. Each stage is essential for moving the funds safely and accurately.

- Initiation (The Company Kicks It Off): The company you authorized (known as the Originator) creates a digital file with all the key details: your bank account info, how much to move, and when.

- Transmission (The Request Is Sent): The Originator doesn't send this file into the void; they send it to their bank, the Originating Depository Financial Institution (ODFI). The ODFI acts as a collection point, gathering payment files from many different businesses.

- Processing (The ACH Operator Takes Over): At specific times each day, the ODFI bundles all these payment files together and sends them in a large batch to an ACH Operator. There are only two in the U.S.: the Federal Reserve and The Clearing House. They're like the central sorting hub for the entire country's ACH payments.

- Routing (Finding the Right Destination): The ACH Operator breaks down the massive batch file, sorting each individual transaction. It then routes every payment instruction to the correct destination bank—in this case, your bank, which is called the Receiving Depository Financial Institution (RDFI).

- Settlement (The Money Arrives): Finally, your bank receives the instruction. It then credits or debits your account exactly as you specified in the authorization. At this point, the transaction is officially complete, and the funds are settled between the two banks.

The Bottom Line: The ACH network is a batch-processing system. Unlike real-time payments (think debit cards or Zelle), ACH transactions are gathered and processed in groups. This is why they typically take 1-3 business days to clear.

Why This Method Is So Reliable

This structured, almost choreographed process is precisely what makes the ACH network so dependable. Every participant, from the business that initiates the payment to the operator sorting it, has a specific role and must stick to the rules.

It’s this rigid framework that protects you. For instance, a company can't just decide to pull a different amount from your account one month. The authorization you signed is a binding agreement that sets the terms. If they break that agreement, you have a clear path to dispute the charge. This regulated flow ensures your money is handled with care every single time.

The Different Ways to Give ACH Authorization

Giving the green light for an ACH transaction isn't a one-size-fits-all deal. How you provide that permission often comes down to the company you're dealing with and the situation you're in. The goal is always the same—to give clear, verifiable consent—but how you get there can look a little different.

Knowing the most common ways to authorize these payments means you’ll be ready for anything, whether you’re setting up direct deposit at a new job or automating your monthly utility bill. While each method has its own flow, they all have to meet the same strict legal standards.

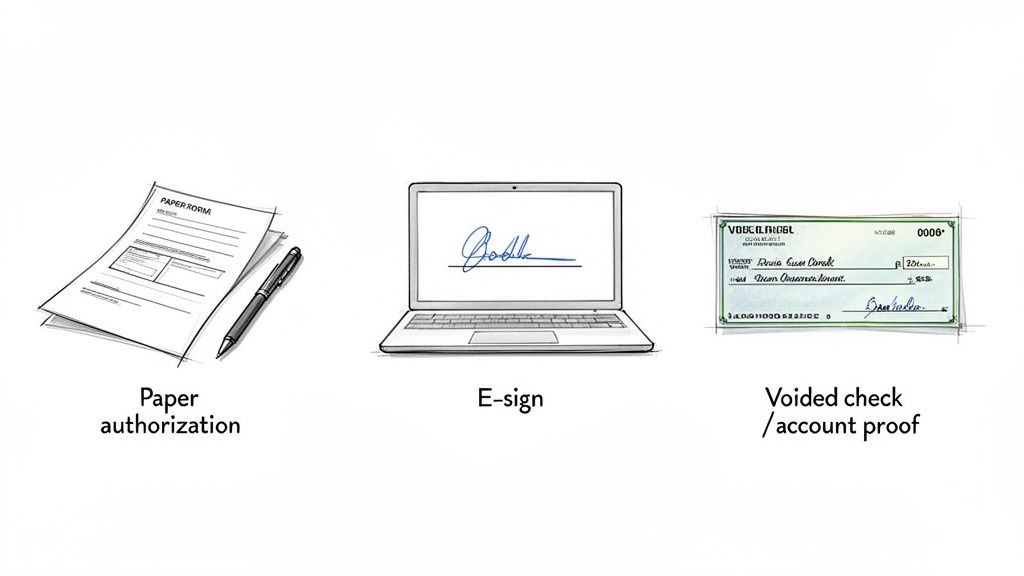

The Old-School Paper Form

The most traditional route is still a physical paper form. You've probably seen one of these during an in-person HR onboarding or when signing up for a membership at a local gym or credit union. It’s simple and straightforward.

With this method, you’ll manually jot down the key details:

- Your full name and address

- Your bank's name

- The type of account (checking or savings)

- Your bank routing number

- Your specific account number

You'll sign on the dotted line, creating a physical record of your agreement. The business is then required to hang onto this form for at least two years after the authorization ends, just in case there are any questions down the road.

The Convenient Online Form

It’s no surprise that online authorization forms have become the go-to for most businesses today. They’re fast, convenient, and let you grant permission from pretty much anywhere with an internet connection.

The process is a lot like the paper version, but you’ll type your information into a secure website or portal instead. You’ll seal the deal with an e-signature. To keep things secure, many online systems add an extra step like instant bank verification or micro-deposits to confirm the account is actually yours before any money starts moving.

Why a Voided Check Still Matters

Whether you fill out a form on paper or online, you’ll often be asked for one more thing: a voided check. This simple document is the gold standard for proving you own the bank account and for triple-checking your banking details.

So, why is it so important? A voided check shows the bank-verified routing and account numbers right there in print, which dramatically cuts down on typos that could cause payment failures or delays. It’s the clearest way to connect your name to the account information on the form.

For renters, new hires, and small businesses, this validation is a critical step. A voided check authorizes debits or credits for rent, payroll, or investments while ensuring full compliance with Nacha's oversight. The scalability of the ACH network, which grew from 3.7 billion transactions in 1996 to 8.8 billion in a recent quarter, is built on this foundation of trust and verification. Explore more about the growth of the ACH system on FederalReserveHistory.org.

And if you don't have a physical checkbook anymore? No problem. You can easily get a digital voided check. It’s a modern fix that provides a bank-compliant document instantly, bridging the gap between traditional verification and today’s checkbook-free world.

Common Uses for ACH Authorization in Daily Life

Even if "ACH authorization" sounds like technical jargon, it’s a concept you probably use all the time without even thinking about it. This simple permission is quietly working in the background of our financial lives, making everything from getting paid to paying bills feel automatic and effortless.

It’s the invisible engine that keeps modern money moving. Every time you set up an automatic payment or enroll in direct deposit, you're giving ACH authorization. Let's look at a few everyday examples that show just how essential this process has become.

Receiving Your Paycheck with Direct Deposit

One of the most familiar uses for ACH authorization is setting up direct deposit for your paycheck. When you start a new job, that form you fill out with your bank details is exactly this—you're giving your employer permission to send your salary straight to your account.

This is a credit-only agreement, which is an important distinction. It means your employer can push money into your account, but they have absolutely no permission to pull money out. With an estimated 30% of American workers now getting paid this way, it's clear how central ACH has become to payroll. You can dig deeper into how the ACH network reshaped payments on FederalReserveHistory.org.

This simple act of signing a form transforms payday. Instead of waiting for a paper check to clear, your funds are reliably available on a set schedule, a convenience that has become an expectation for most employees.

Automating Your Recurring Bills

Automated bill payment is another classic example. Think about your monthly mortgage, rent, car loan, or utility bills. When you set up "autopay," you're providing an ACH authorization that lets the company pull the payment from your account on the same day each month.

This is a debit authorization. It’s a lifesaver for avoiding late fees and protecting your credit score because you never have to worry about forgetting a due date. The authorization will either specify a fixed amount, like for a loan, or allow for a variable amount within a certain range, which is common for things like your electric bill.

Streamlining Business-to-Business Payments

ACH authorization is also a game-changer for small business owners and contractors trying to manage their cash flow. It’s a simple way to pay vendors, suppliers, and freelancers without the old-school hassle of writing and mailing paper checks. A business owner can authorize a recurring ACH payment to a key supplier, making sure inventory arrives on time and keeping that business relationship strong.

Likewise, businesses often use ACH to pay their independent contractors. The contractor usually provides their account details, often with a voided business check, to get everything set up. You can learn more about this in our guide on how to create a voided check for your business. This system gives contractors a predictable and reliable payment schedule, which is a huge plus.

ACH authorization plays a crucial role in so many different financial interactions. The table below breaks down some of the most common scenarios and highlights who benefits from this simple yet powerful tool.

| Use Case | Who It Helps | Primary Benefit |

|---|---|---|

| Payroll Direct Deposit | Employees & Employers | Guarantees on-time, reliable payment for employees and reduces administrative work for HR. |

| Recurring Bill Pay | Consumers & Service Providers | Prevents missed payments and late fees for consumers; ensures consistent revenue for companies. |

| Rent & Mortgage Payments | Tenants, Homeowners & Landlords | Automates essential housing payments, providing security for both parties. |

| Loan Repayments | Borrowers & Lenders | Simplifies the repayment process, reducing the risk of default and credit score damage. |

| B2B Vendor Payments | Businesses & Suppliers | Creates predictable cash flow and strengthens supply chain relationships by ensuring timely payments. |

As you can see, the core idea is always the same: creating a reliable, automated flow of funds that saves everyone time and eliminates the friction of manual payments.

Understanding Your Rights and Financial Security

Giving a company your banking details for an ACH authorization can feel like a leap of faith. But it's important to know you aren't just handing over control. The whole system is backed by strict federal laws and industry rules that put you in the driver's seat, protecting your money and giving you the final say.

The cornerstone of this protection is Regulation E. Think of it as the consumer's bill of rights for any electronic payment. This federal law clearly lays out your power to stop payments, dispute errors, and hold companies and banks accountable.

Your Right to Revoke Authorization

One of the most powerful rights you have is the ability to cancel an ACH authorization whenever you want. Just because you said "yes" once doesn't mean it's forever. If your circumstances change or you simply no longer want a company to pull money from your account, you can revoke your consent. They are legally required to stop.

So, how do you do it? Start by contacting the company directly. Your original agreement should have instructions on how to cancel, but it's always smart to put your request in writing—an email works perfectly—to have a record. After you've told the company, give your bank a heads-up, too. This ensures they know to block any future attempts.

Disputing an Unauthorized Charge

What if you check your bank statement and see a charge you never approved? Regulation E has you covered there, too. You have a clear path to get your money back.

The moment you spot a debit you don't recognize, contact your bank immediately. They are required by law to investigate your claim. If they confirm it was an error or fraud, they must correct it, which almost always means putting the money right back into your account. This is a critical safety net that protects you from being on the hook for someone else's mistake or malice.

Your Security is Paramount: The ACH network isn't just built on rules; it's reinforced by some serious tech. Trust is bolstered by layers of security like 256-bit encryption. Plus, strict Nacha guidelines demand detailed audit trails with timestamps and unique codes, which is a lifesaver for accountants tracking authorizations. For people who don't have checkbooks, like loan applicants, providing an ACH authorization with a digital voided check is a game-changer. It saves time and is guaranteed to be accepted by HR and banks. You can dive deeper into ACH payment technology statistics and trends on iCheckGateway.com.

At the end of the day, these legal and technical safeguards mean that signing an ACH authorization isn't about giving up control. It’s about using a secure, regulated system designed from the ground up to keep your financial well-being front and center.

Your Top ACH Authorization Questions, Answered

Even when you've got the basics down, it’s normal to have a few nagging questions about ACH authorizations. Let's tackle some of the most common ones so you can manage your electronic payments like a pro.

How Long Does an ACH Authorization Last?

Think of an ACH authorization as an open-ended agreement. It doesn’t just expire on its own. It stays active until one of two things happens: either the deal is done (like you’ve made the final payment on a car loan), or you formally cancel it.

The key takeaway is that you're always in the driver's seat and can revoke your permission whenever you need to.

Can I Stop an ACH Payment I Already Authorized?

Yes, you absolutely can. You have the right to stop an ACH payment before it happens. Your first move should be to contact the company that pulls the money and follow their steps for cancellation—getting it in writing is always a smart move.

As a backup, it's also a good idea to tell your bank you want to place a stop payment order. This acts as a safety net to make sure the transaction doesn't go through.

What's the Difference Between Debit and Credit Authorization?

This one's all about the direction the money is moving. It's actually pretty straightforward.

- ACH Credit Authorization: This is you giving a thumbs-up for someone to push money into your account. The classic example is setting up direct deposit with your employer.

- ACH Debit Authorization: This is you giving permission for a company to pull money out of your account. This is how you pay for recurring things like your monthly streaming service or gym membership.

The entire ACH Network, which is massive—we're talking 8.8 billion payments worth $23.2 trillion in just one recent quarter—runs on the trust built into these simple authorizations. Its continuous growth shows just how essential this system has become. You can find more ACH payment technology statistics on iCheckGateway.com to see the full picture.

What Happens If I Enter My Account Information Incorrectly?

It happens to the best of us, but a simple typo can throw a wrench in the works. If you accidentally enter the wrong account or routing number, the ACH transfer will almost certainly fail and get sent back. The company will get an error notification and will usually contact you to sort out the correct details and try the payment again.

This is why it pays to be meticulous. Always double-check your numbers before hitting "submit." Using a voided check to confirm your details is one of the easiest ways to get it right the first time.

Don't have a checkbook handy but need to provide bank account proof? VoidedCheck.org lets you create a professional, compliant voided check in less than a minute. Our service is fast, secure, and guaranteed to be accepted for setting up payroll, direct deposit, and other ACH payments. Create your voided check instantly at https://voidedcheck.org.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.