A Guide to Your BMO Direct Deposit Form

Getting your BMO direct deposit set up is one of those small but significant steps that can really simplify your financial life. It's all about making sure your paychecks, government benefits, or any other regular payments get into your account safely and on time. Forget paper checks and trips to the bank; this is how you make your money work for you from the get-go.

Why Your BMO Direct Deposit Setup Matters

Filling out that BMO direct deposit form is more than just paperwork. It's a foundational move toward smarter, more secure money management. As the employee or payee, it means you can count on your funds being there predictably, right on schedule. This simple switch eliminates the risk of a lost or stolen check, which can be a real headache and throw your budget off track.

Think about the time it saves, too. No more running to a BMO branch or an ATM just to deposit a check. Your money just shows up when you expect it, ready for bills, savings, or whatever you need. That kind of reliability brings real peace of mind and makes financial planning a whole lot easier.

Benefits for Employers and Payors

The upsides aren't just for the person getting paid; they're huge for employers and other payors as well. Shifting to direct deposit automates the whole payroll process. This cuts down on the administrative burden and the costs of printing and mailing checks, but maybe more importantly, it slashes the potential for human error.

By switching from paper to electronic direct deposit, companies can reduce per-pay-cycle processing costs and lower paper-handling errors by an estimated 30–50%.

This efficiency isn't just theoretical—it leads to real savings and fewer payment headaches. For example, companies that adopt electronic enrollment often see a dramatic drop in failed deposits. One payroll provider saw their failed payment rate fall from about 1.8% to just 0.6% in the first year after going digital. You can dig into these financial efficiencies in the FDIC’s findings.

Ultimately, the BMO direct deposit form is the key to unlocking these benefits for everyone, creating a much smoother financial relationship all around.

Locating Your BMO Account Information

Before you can fill out any forms, you need your banking numbers handy. Thankfully, BMO makes it pretty easy to find them, whether you prefer to go digital or have a chequebook tucked away in a drawer.

The BMO mobile app is usually the quickest route. Just log in and tap on the specific account you want your money deposited into. Right on the main screen for that account, often under the account name, you'll see your transit and account numbers listed.

If you're on a computer, BMO Online Banking works just as well. Once you're signed in, head to your account summary, click on the account in question, and look for an option like “Account Details.” All the numbers you need will be right there.

Dust Off That Chequebook

Still have physical cheques? You're in luck. The bottom of every cheque has all the information your employer or payor needs.

A standard BMO cheque lists a series of numbers along the bottom edge. These are your 5-digit transit number (identifying your branch), the 3-digit BMO institution number (001), and your 7 to 12-digit personal account number. Getting these digits exactly right is critical. In fact, industry data shows incorrect banking details are behind 40–60% of all payment rejections.

Expert Tip: Take a moment to double-check every single digit. A simple typo is the most common culprit behind a failed direct deposit setup, and it can delay your paycheque for days or even weeks.

To help you find what you need quickly, here’s a breakdown of where to look.

Where to Find Your BMO Account Details

| Method | Instructions | Information Found |

|---|---|---|

| BMO Mobile App | Log in, select your account, and view the "Account Details" or summary screen. | Account Number, Transit Number, Institution Number |

| BMO Online Banking | Sign in on a desktop, navigate to the account, and click on "Account Info." | Account Number, Transit Number, Institution Number |

| BMO Cheque | Look at the series of numbers at the bottom of a physical cheque. | Transit Number (first 5 digits), Institution Number (next 3 digits), Account Number (last set of digits) |

| Bank Statement | Check the top section of a recent BMO e-statement or paper statement. | Full Account Number, Transit Number |

This table should get you the numbers you need for any Canadian direct deposit.

A Quick Note on U.S. Payments

If you're getting paid from a company in the United States, they'll likely ask for a 9-digit ABA routing number, not your Canadian transit number. This is a completely different number used for the U.S. banking system. You can find your specific ABA number by checking your BMO online account or by calling the bank directly. Always clarify which country the payment is coming from to ensure you provide the right information.

Getting and Filling Out Your BMO Direct Deposit Form

Getting your hands on a BMO direct deposit form is pretty simple. You've got two main options: grabbing it yourself online or stopping by a branch for some face-to-face help. Which one you choose really just comes down to personal preference.

The quickest route by far is through BMO Online Banking. This is the go-to for most people because you can generate a pre-filled PDF in minutes without leaving your desk.

The Digital Path: Using BMO Online Banking

First things first, log in to your BMO Online Banking account. Once you're in, find the specific chequing or savings account you want your paychecks routed to and click on it.

From your account page, you'll need to look for a link related to account services or documents. It's usually labeled something like "Direct Deposit Form" or "Void Cheque/Direct Deposit Info." A single click will generate an official PDF that’s already populated with your crucial banking info.

This generated document will have all the key details your payroll department needs:

- Your full name

- Your branch transit number

- The BMO institution number (001)

- Your complete account number

After you've downloaded the PDF, you can save it and email it directly to your employer or print it out if they need a hard copy. It's an official document that serves as proof of your account details.

Expert Tip: Take 30 seconds to double-check the pre-filled numbers on the form. While errors are rare, a quick glance to confirm the account and transit numbers match your records can save you from a major payroll headache later.

The In-Person Option: Visiting a BMO Branch

Not a fan of online banking? No problem. Just head over to your nearest BMO branch. This is a great alternative if you want a little guidance or if your employer specifically requested a form with an official bank stamp.

Just walk up to a teller or ask to speak with a personal banker. Let them know you need a direct deposit form, and they can print one out for you right there. The big plus here is the official bank stamp they can add, which provides an extra layer of verification that some organizations appreciate.

Filling In the Final Details

Whether you have a digital PDF or a paper copy from the branch, there are a few blank spots you'll need to fill in before it's ready to go.

- Your Personal Info: Make sure your full legal name and current address are written exactly as they appear on your bank statements.

- Employer/Payor Details: Write in the full name and address of the company or government agency that will be paying you.

- Splitting Your Deposit (Optional): Many forms give you the option to divide your deposit across multiple accounts. This is a fantastic way to automate your savings. For instance, you could set it up to send 80% of your pay to your chequing account and the other 20% directly into a savings account. You'll just need to provide the details for the second account and specify the percentage or flat amount for each.

- Signature and Date: The last step is to sign and date the form. This is your official authorization for your employer to start sending payments to your BMO account.

With that done, your form is complete and ready to be submitted

Common Alternatives to the Official Form

While filling out BMO's official form is a solid way to go, it's definitely not the only way. In my experience, most payroll departments are just as happy with a couple of other options that give them the exact same information. Knowing these alternatives can save you a trip to the bank or a hunt for a printer.

The most common substitute, and one that’s been trusted for years, is a simple voided cheque. It’s the classic method for a reason. A BMO cheque has everything payroll needs printed right on it: your name, your branch’s 5-digit transit number, BMO's 3-digit institution number (001), and your full account number. It's a physical, undeniable confirmation of your banking details.

How to Properly Void a Cheque

Using a voided cheque is straightforward, but you need to do it correctly so it can't be accidentally processed as a payment. Just grab a blank cheque from your book.

Using a pen with dark ink, write the word “VOID” in big, bold letters right across the middle. The key is to make sure you don't write over the series of numbers at the bottom of the cheque—that’s the information your employer needs to read clearly. You're simply making the cheque unusable for payment while keeping the account info perfectly legible.

Key Takeaway: A voided cheque is a time-tested, secure way to provide your banking details. It proves account ownership and gives payroll all the routing information they need in a format they’ve seen a thousand times.

What if you don't use physical cheques anymore? Not a problem. You can use a tool to create a digital sample; this voided cheque generator is a great option for that.

Other Official Bank Documents

If a voided cheque isn't an option, you can always get another official document directly from BMO. Just head into any branch and ask the teller for a direct deposit letter or a stamped bank statement.

They can print out a document that officially lists all your account information. Getting it stamped by the bank adds that extra layer of verification that some employers really appreciate. This document carries the same authority as the official form and is a perfect solution when you need something more formal.

Submitting Your Form and What to Expect

Alright, you’ve got your BMO direct deposit form filled out and ready to go. The last piece of the puzzle is getting it into the right hands. How you do this really depends on your employer's or payor's process. The best first step? Just ask your manager or the HR department what they prefer.

Most companies these days have a few standard ways of handling this. You might be asked to upload a digital copy to a secure online payroll portal, email the PDF to a specific person in accounting, or simply hand over the physical form.

How Long Does It Actually Take?

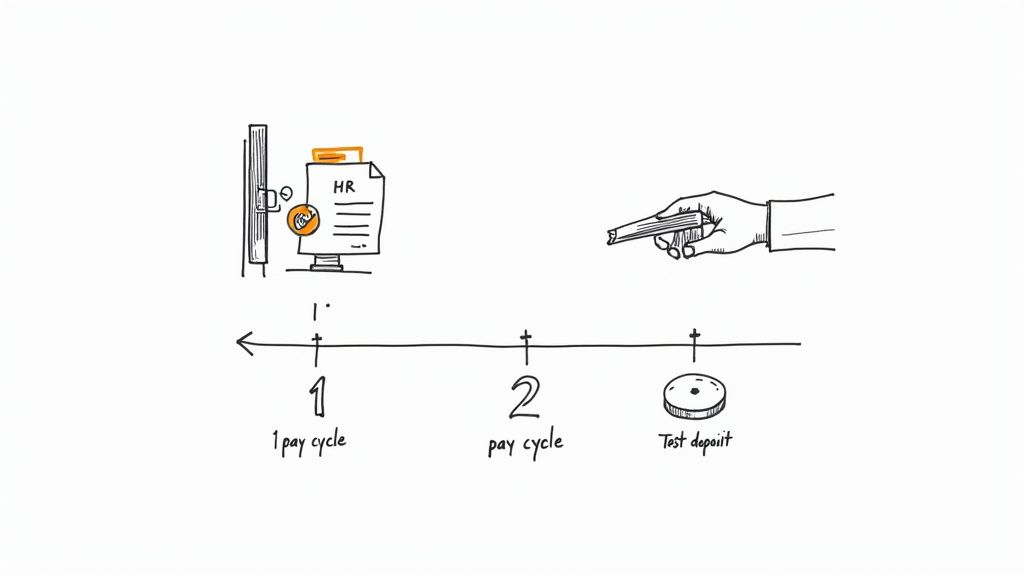

Once you've submitted the form, it's not an instant switch. Your company's payroll team needs to manually input your banking details into their system and make sure everything lines up with their pay schedule.

Expectation Check: It’s realistic to plan for your direct deposit to kick in within one to two full pay cycles. So, if you're paid bi-weekly, don't be surprised if it takes anywhere from two to four weeks for that first payment to land in your BMO account.

This timeframe gives everyone enough buffer to process the change. It's pretty common to receive one more physical cheque after submitting your form, so don't toss your old pay stubs just yet.

The Test Deposit: A Good Sign

Before your first full paycheck arrives electronically, many employers will send a tiny "test deposit" to your account—we're talking just a few cents. This isn't a mistake; it's their way of confirming the account details are correct and the connection is solid. Seeing that small transaction is the green light that everything is working as it should.

A few days after you hand in the form, it’s never a bad idea to send a quick, polite follow-up email to HR. A simple, "Just wanted to confirm you received my direct deposit form" can save you a lot of headaches later on and ensures you're on track for a smooth transition to paperless paydays.

A Few Common BMO Direct Deposit Questions

Setting up your direct deposit is usually straightforward, but a few questions always seem to come up. It's your money, after all, so it's natural to want everything to go smoothly. Let's walk through some of the most common things people ask.

How Long Does It Take for the First Direct Deposit to Kick In?

This is the big one, and you can generally expect it to take one to two pay cycles. After you hand in your form, the payroll department at your company has to manually input and verify everything.

Don't be alarmed if you still get a paper cheque for your next payday. That's completely normal and just means their system hasn't fully processed your request yet. The one after that should be the first one to land directly in your account.

I Think I Messed Up a Number on the Form. What Now?

If you get that sinking feeling you typed in the wrong account or transit number, talk to your HR or payroll contact right away. The sooner you flag the mistake, the better.

A simple typo can send your payment into a kind of financial limbo. Acting fast is the key to preventing a major delay.

A Quick Note: A failed deposit doesn't mean the money vanishes. The funds will eventually bounce back to your employer, but it can take a while to sort out the error and get your payment reissued.

Can I Split My Paycheque Between Different BMO Accounts?

Absolutely. This is actually a fantastic way to automate your savings. The BMO direct deposit form has dedicated sections for splitting your pay. You can choose to send a fixed amount or a percentage to different accounts.

For example, you could set it up to automatically transfer $200 from every paycheque into a BMO savings account. The rest would go into your chequing account for your regular bills and spending. It’s a classic "pay yourself first" move that makes saving effortless.

Need to provide banking info but don’t have a chequebook handy? VoidedCheck.org is a great little tool that lets you create a valid voided check in less than a minute. You can create your voided check at https://voidedcheck.org.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.