How Long Does Direct Deposit Take? Your Payday Timeline Explained

So, you're waiting on a direct deposit and wondering when it'll actually hit your account. The straight answer is that most direct deposits show up within one to three business days after your employer sends in the payroll. It's a very dependable system, but it's not quite instantaneous.

A Peek Behind the Direct Deposit Curtain

It helps to think of the direct deposit process like a carefully scheduled delivery. Your employer bundles up your paycheck and passes it to a secure courier, who then makes sure it arrives at your bank right on payday.

This whole journey happens on the Automated Clearing House (ACH) network, which is the backbone for most electronic payments in the United States. Since employers are sending massive payroll files for all their employees at once, the network needs a little time to sort everything out.

The good news? Most people find their money is available by 9 a.m. on their scheduled payday, especially when their employer gets the payroll submitted a couple of days in advance. You can get more details on how different financial institutions handle these transfers in our articles about specific banks.

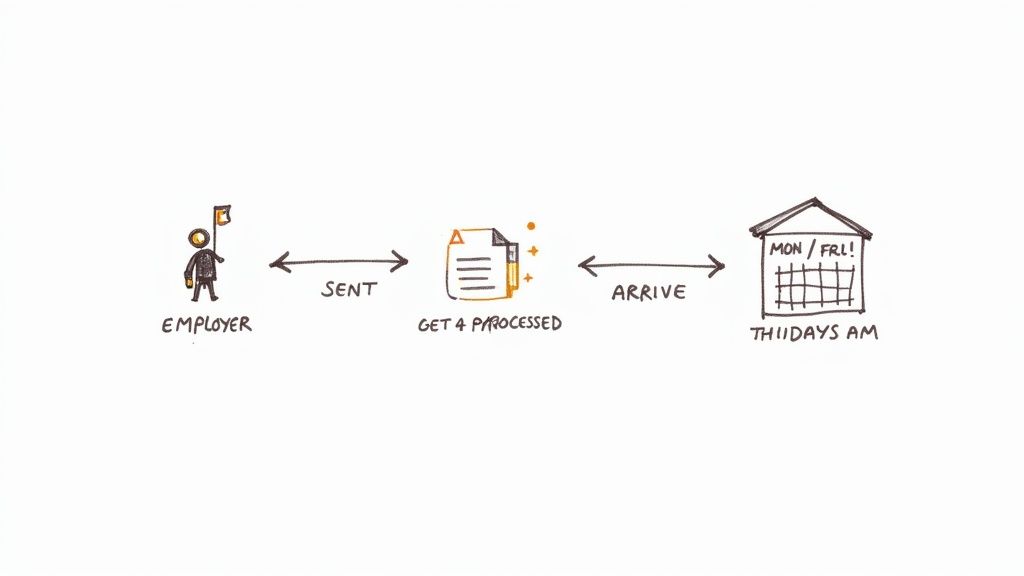

Let's walk through a super common scenario to see how this plays out in real life.

Typical Direct Deposit Timeline for a Friday Payday

Here’s a step-by-step look at the journey your money takes to get to you by Friday.

| Day of the Week | Action Taken |

|---|---|

| Monday/Tuesday | Your employer finalizes payroll and submits the payment file to their bank. |

| Wednesday/Thursday | The ACH network receives and processes all the payment instructions in a batch. |

| Friday Morning | Your bank receives the funds from the ACH network and makes them available in your account. |

As you can see, the work that happens early in the week is what ensures your money is ready and waiting for you on Friday morning. It's all about that built-in processing time.

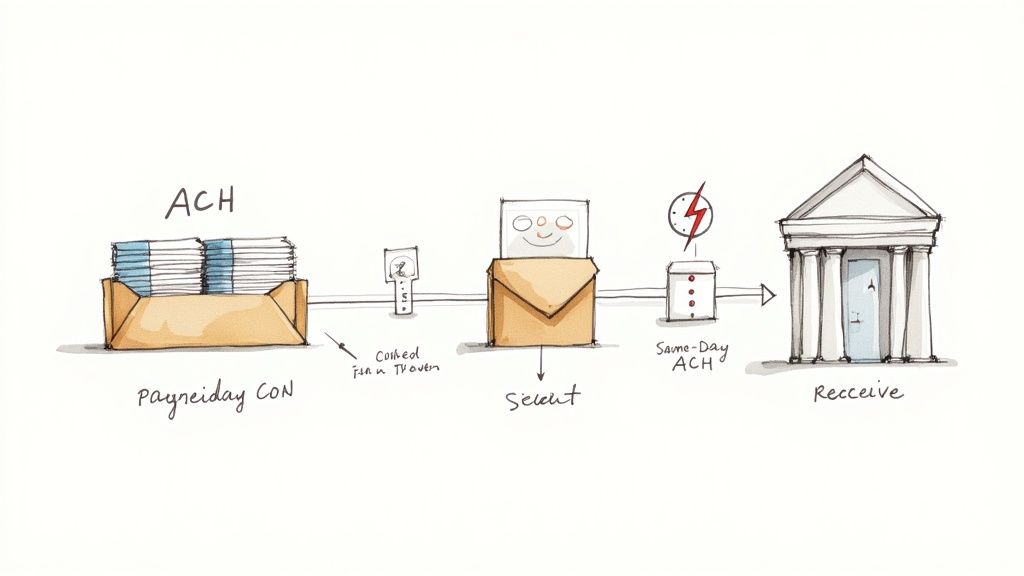

The Journey Your Paycheck Takes Through the ACH Network

So, why isn't direct deposit instantaneous? To get to the bottom of that, you have to understand the system that makes it all happen: the Automated Clearing House (ACH) network. The best way to think of it is as a massive, secure highway for money, not a private jet carrying just your paycheck.

Instead of zipping each employee's pay over one by one, your employer groups the entire company's payroll into one giant file. That file is then handed off to their bank, which sends it into the ACH network. The network then processes these huge "batches" of payments at specific, scheduled times throughout the day.

This batching system is what makes the whole process incredibly efficient and secure for moving millions of payments around the country. It’s also the main reason for that built-in delay. This method has become the gold standard for good reason—recent data shows that about 95.15% of American workers get paid electronically. You can dig deeper into payroll processing times on getontop.com if you're curious.

Standard ACH vs. Same-Day ACH

The ACH network isn't a one-speed system. There are a couple of different "lanes," and the one your employer chooses directly impacts when your money shows up.

- Standard ACH: This is the workhorse of payroll. It's reliable, cheap, and what most companies use. The trade-off is that it typically takes one to three business days for the money to complete its journey.

- Same-Day ACH: Just like it sounds, this is a much faster option that can get money settled on the same business day it's sent. It’s a great tool, but it's less common for regular payroll because it costs more and has much stricter deadlines for submission.

The key thing to remember is that the ACH system was designed for security and handling enormous volume, not for instant speed. That one-to-three-day window is a feature, not a bug—it gives the banks on both sides of the transaction the time they need to verify and process everything correctly.

Ultimately, your employer decides which speed to use based on their payroll provider and internal schedule. For almost everyone, the standard ACH process is what gets your money to you safely and reliably, right on schedule.

Common Reasons Your Direct Deposit Might Be Delayed

While direct deposit is incredibly reliable, delays do happen. It’s frustrating when you expect money to hit your account and it's not there, but there’s usually a simple explanation. Most of the time, the holdup boils down to timing, scheduling, or a tiny human error.

One of the most common culprits is your employer missing their payroll submission deadline. If they send the payment file to their bank even a little bit late, it can miss the cutoff for the day's ACH processing batch. This seemingly small slip-up can easily push your deposit back by a full business day.

Weekends and Holidays: The ACH Network’s Off Days

A crucial detail to remember is that the ACH network isn't a 24/7 operation. It takes a break on weekends and all federal banking holidays. This is a huge factor in your deposit’s timing.

For instance, let’s say your payday lands on a Friday, but it's also a federal holiday like Veterans Day. You won't see that money on Friday. A proactive employer will process payroll a day earlier so the funds clear on Thursday. If they don't adjust their schedule, you’ll likely be waiting until Monday morning to get paid.

Key Takeaway: A Monday holiday can create a ripple effect. If your HR department normally submits payroll on Monday for a Friday payday, that holiday pushes their timeline back a day. That one-day delay can cascade, meaning your deposit might not arrive until the next Monday.

Bank Processing and First-Time Setups

Even after the ACH network gives the green light, your own bank has its own internal process for posting funds. Most major banks are quick and post deposits in the early morning hours, but their exact schedules and cutoff times can differ.

Your very first paycheck from a new job is another frequent source of delays. There are a couple of reasons for this initial hiccup:

- Account Verification: Some companies run a "prenote" test before your first official paycheck. This is a zero-dollar transaction sent just to confirm your routing and account numbers are valid. This verification step can sometimes add an extra pay cycle before your real direct deposit starts.

- Manual Errors: It happens to the best of us—a simple typo when entering your account or routing number. If the numbers are wrong, the payment will be rejected and sent back to your employer. They'll have to fix the information and reissue the payment, which often means you'll get a paper check for that first pay period.

Why Direct Deposit Isn't Instant Everywhere

If you've ever chatted with a colleague from the UK or Australia about payday, you might have noticed something odd. Their direct deposits often hit their accounts almost instantly, while here in the U.S., we're used to a bit of a wait.

This isn't a fluke. The speed of any electronic payment boils down to the financial plumbing of the country it's in. While the U.S. ACH system is a workhorse, built to handle enormous volumes of payments in scheduled batches, many other countries built their systems with real-time transfers as the top priority from day one.

A Look at Faster Systems Abroad

In many parts of the world, payroll processing is a near-instant event. These modern networks were designed from the ground up for speed and 24/7 availability.

- United Kingdom: The UK runs on the Faster Payments Service (FPS). Just as the name implies, it allows payments to be sent and received in seconds, any time of day, any day of the year.

- Australia: Down under, they have the New Payments Platform (NPP), which offers a similar instant-payment experience between participating banks.

This global perspective helps put the typical one to three-day window for U.S. payroll in context. It’s not slow, necessarily—it's just how our reliable, batch-based system was designed to work. The difference becomes even starker when you're sending money across borders.

A global payroll report highlighted that while domestic direct deposits take 0–3 days, sending pay internationally can stretch to 2–7 days. That extra time gets eaten up by compliance checks, currency conversions, and hopping between different banking systems. You can dig into these timelines with global payroll processing insights on easystaff.io.

Ultimately, how long your deposit takes is less about a universal technological limit and more about the specific rulebook each country’s financial network plays by. For payments within the U.S., our ACH network remains incredibly secure and dependable, even if it’s not the fastest sprinter in the global race.

It’s a feeling we all dread: you check your bank account on payday, and the money isn't there. That initial surge of panic is real, but before you jump to conclusions, there’s a straightforward path to figuring out what’s happening.

First, take a deep breath and look at the calendar. Federal holidays are a common culprit for payroll delays. If there was a banking holiday on Monday or Tuesday, it can easily push a Friday payday back a day, so a quick calendar check might solve the puzzle right away.

Who to Talk to First

If a holiday isn't the issue, your next step is to get in touch with your employer's HR or payroll department. Resist the urge to call your bank first. Your employer is the one who sends the money, so they are ground zero for information.

When you connect with them, have a few specific questions ready:

- Could you confirm the exact date and time you submitted payroll?

- Do you have an ACH trace number for my deposit?

- Can we double-check the routing and account numbers you have on file for me?

Think of the ACH trace number as a tracking number for your paycheck. If your employer confirms everything was sent correctly, this number is the key piece of evidence you'll need.

Your company's payroll team can see their side of the transaction clearly. They'll know if the payment went out successfully with the rest of the company's payroll or if it bounced back because of an error, like a typo in your account number.

Once your employer has confirmed the payment was sent and has given you the trace number, then it's time to contact your bank. With that number, their support team can look into their system to see if the deposit is pending or if there was a hang-up on their end.

How to Set Up Direct Deposit to Avoid Future Issues

The best way to deal with direct deposit delays is to stop them before they even start. Taking the time to set up your account correctly is the most critical step you can take for reliable, on-time payments.

Believe it or not, a simple typo in an account or routing number is the number one culprit behind failed payments. It happens all the time. To avoid this, don't ever enter the numbers from memory.

Instead, your best bet is to use a pre-filled direct deposit form from your bank's online portal or app. Another foolproof method is providing a voided check, which guarantees the information is 100% accurate. If you don't have a physical checkbook, you can use a voided check generator to create a valid one in just a few clicks.

Understanding the Prenote Test

You might notice that your very first paycheck still arrives as a paper check, even after setting up direct deposit. This is often because your employer is running a security check called a prenote.

A prenote (or prenotification) is essentially a zero-dollar test transaction. Your employer sends it to the bank account information you provided to make sure everything is connected properly.

A prenote simply confirms that the account and routing numbers are valid and can receive funds. If it’s successful, your actual direct deposit will start on the next pay cycle. This verification is a key reason your very first paycheck might arrive as a paper check.

Common Questions About Your Direct Deposit

Even after you get the hang of how direct deposits work, a few specific questions tend to pop up. Let's tackle some of the most common ones you might have about your paycheck's timing.

Can My Direct Deposit Show Up Before My Official Payday?

Yes, it absolutely can. Many modern banks and fintech apps now offer early direct deposit, sometimes making your money available up to two days ahead of schedule.

How do they pull this off? It's pretty clever. As soon as they get the heads-up from the ACH network that your paycheck is on its way, they advance you the money immediately. They don't wait for the funds to officially clear and settle. Keep in mind, this is a special feature from your bank, not something your employer controls.

What Time of Day Does Direct Deposit Usually Hit My Account?

For the most part, you can expect your money to arrive in the wee hours of the morning on your payday. The sweet spot is typically between midnight and 6 a.m.

The exact moment depends on when your bank runs its daily batch of incoming ACH transfers. But for almost everyone, the funds are there and ready to go by the time you wake up, and almost certainly by 9 a.m. local time.

Do Direct Deposits Go Through on Weekends or Holidays?

Nope. The ACH network, the system that powers all these transfers, takes weekends and federal holidays off, just like a traditional bank.

So, what happens if your payday lands on a Saturday or a holiday like Thanksgiving? Your employer will almost always send the payment instructions a bit earlier to compensate. This means you should see your money hit your account on the last business day before the weekend or holiday begins.

Ready to set up your direct deposit without any guesswork? With VoidedCheck.org, you can generate a perfectly formatted, compliant voided check in under a minute. It’s the fastest way to make sure your routing and account numbers are spot on. Create your voided check instantly at https://voidedcheck.org.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.