How to Find Routing Number: A Simple Guide for Secure Bank Transfers

When you need your routing number, you usually need it now. The quickest, old-school way is to just grab one of your paper checks and look at the bottom left corner. But if you don't have a checkbook handy, don't worry—logging into your bank's website or mobile app will get you the same nine-digit code, typically right there in your account details.

You'll need this number for everything from setting up direct deposit with a new job to paying your bills online. It's a fundamental piece of your financial identity.

What Exactly Is a Routing Number?

Before you go hunting for it, let's quickly break down what this number actually does. The best way to think about it is like a bank's unique mailing address within the U.S. financial network. This nine-digit code, also called an ABA routing transit number, tells other banks and financial systems exactly where to send the money.

Your account number, which sits right next to it on a check, is more like your specific apartment number in that building. You absolutely need both to make sure your money gets to the right place.

Why You Can't Afford to Get It Wrong

Getting this number right isn't just a suggestion; it’s crucial for most of the financial tasks we handle every day. It’s the key to making electronic payments and transfers happen smoothly.

You'll definitely be asked for it when:

- Setting up direct deposit for your paycheck.

- Automating bill payments for your mortgage, car, or utilities.

- Connecting your bank account to apps like PayPal or Venmo.

- Receiving government funds, like a tax refund or Social Security benefits.

Accuracy is everything. With the U.S. ACH network processing an astounding 8.5 billion payments in Q1 2025 alone, there's no room for error. A single mistyped digit can cause a payment to fail or be seriously delayed. You can dig deeper into payment trends in this global payments report from McKinsey.

Key Takeaway: Always, always double-check your routing number before you hit submit. A tiny mistake can turn into a huge headache, leading to returned funds and even late fees. This guide will walk you through the most reliable ways to find and confirm it.

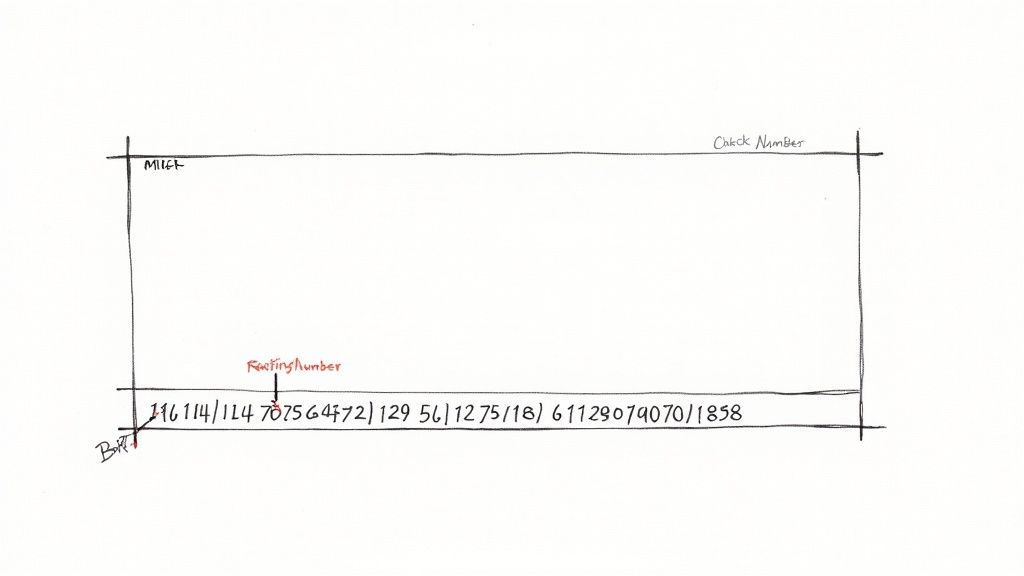

Finding Your Routing Number on a Paper Check

If you have a checkbook handy, you’re holding one of the easiest and most reliable sources for your bank's routing number. Just look at the long string of numbers printed along the bottom edge. This is called the MICR line, and it’s printed in a special magnetic ink.

That MICR line contains three distinct groups of numbers. The one you’re looking for is the very first set of nine digits on the far left. Think of it as your bank's specific address for financial transactions.

Decoding the MICR Line

Let's say you just started a new job and need to set up direct deposit. HR asks for your account details or a voided check. Grabbing one of your checks is the fastest way to get them the right info, since the numbers are always printed in the same order for this exact purpose.

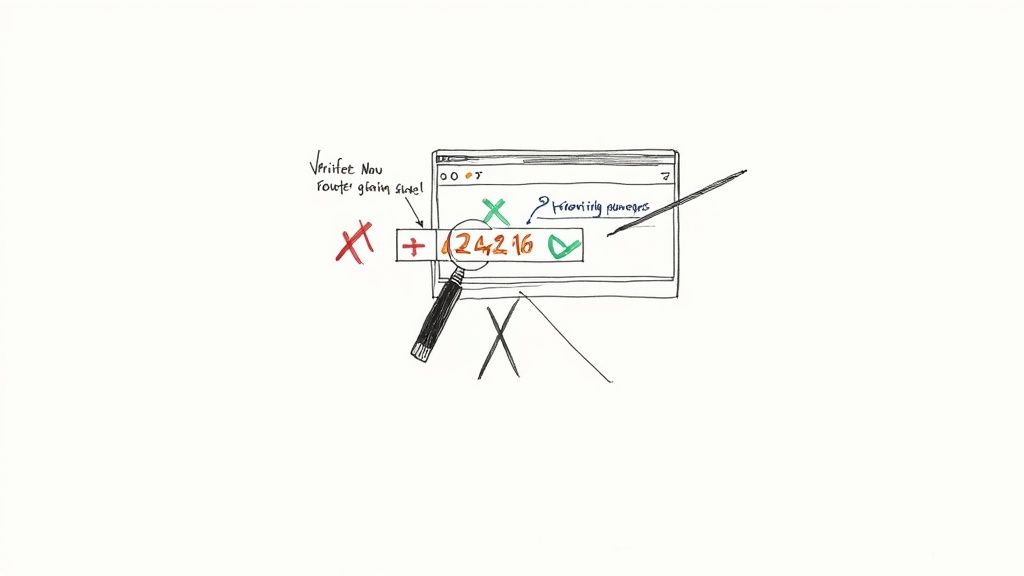

This diagram shows you precisely where to find it on a standard U.S. check.

As you can see, the routing number is the nine-digit sequence at the bottom-left corner. It's immediately followed by your account number (which can vary in length) and, finally, the individual check number.

These routing numbers are truly the foundation of the U.S. financial system, guiding trillions of dollars in electronic payments. The simplest way to find yours is to look at positions 1-9 on your check’s MICR line. You can learn more about how these numbers power ACH transactions at Stripe.com.

Pro Tip: While your account number's length might differ from someone else's, the routing number is always nine digits long. Remembering this simple rule makes it easy to spot the right number every time.

But what if you don't have a physical checkbook? No problem. You don't need to order a whole box just to set up one direct deposit. A secure online tool is a great alternative, allowing you to create a valid voided check in minutes.

Finding Your Routing Number with Digital Banking

If you don't have a paper check handy, don't worry. Your bank's website or mobile app is the next best place to look, giving you access to your account details 24/7.

Once you log in, the process is usually straightforward. Just navigate to the specific checking or savings account you need information for. From there, you'll want to find a section labeled something like "Account Details" or "Account Information."

For instance, in the Chase mobile app, you simply tap on your checking account and hit "Show details" to see both your routing and account numbers. With Bank of America, you'd select your account, then click the "Information & Services" tab to find the same details listed clearly.

The Big Mix-Up: Wire Transfers vs. ACH

Here’s a common pitfall that can cause major headaches: the routing number for a direct deposit is often different from the one used for a wire transfer. Many banks, especially the larger ones, use separate numbers for these transactions.

- ACH Routing Number: This is your everyday routing number. It’s what you’ll use for direct deposits from your employer, setting up automatic bill pay, and other electronic transfers via the Automated Clearing House (ACH) network.

- Wire Transfer Routing Number: This one is specifically for domestic wire transfers, which are handled by a different system (like FedWire).

Grabbing the wrong number can cause your payment to bounce or get stuck in limbo for days. If you’re sending or receiving a wire, it's critical to double-check with your bank to get the correct number.

Key Insight: Before you copy and paste that number, take a second to confirm what it's for. Setting up your paycheck? You need the ACH (sometimes called "electronic") routing number. Making a large, time-sensitive payment? You almost certainly need the specific wire transfer number.

Your bank's website is the ultimate source of truth here. Most have a help section that clearly explains which number to use for what. You can also use our comprehensive list of bank routing numbers as a quick reference to find the right information for your bank.

What If You Don't Have a Check or App Access?

Let's say you've misplaced your checkbook and can't seem to log into your bank's app. It happens. Thankfully, there are still a couple of straightforward, reliable ways to track down your routing number when the digital route is a dead end.

Your printed bank statement is a great place to start. Most banks print the routing number right on the statement itself, usually up in the header with your name, address, and account number. Just scan the top portion for a nine-digit number often labeled "Routing Number" or "ABA Number."

This is a fantastic option if you keep paper records or have a PDF statement saved on your computer. It’s a secure and direct source of information straight from the bank.

Go Straight to the Source: Contact Your Bank

When a statement isn't handy, your best bet is to get in touch with your bank directly. You can either give them a call or just pop into a local branch.

- Pick up the phone: Find your bank's official customer service line. Once they confirm who you are, a representative can give you the correct routing number for your account. You'll definitely need to answer a few security questions to prove you're the account holder.

- Visit in person: Just walk into one of your bank's branches. A teller or banker can pull up your account in a flash and provide the routing number on the spot. Don't forget to bring a valid photo ID, like your driver's license.

A Quick Pro Tip: If you decide to call, have your account number and personal details handy before you dial. This usually means your full name, date of birth, and maybe the last four digits of your Social Security number. Having this ready makes the whole verification process much quicker and less of a hassle.

Going directly to the bank is the surest way to get accurate, current information. This is especially critical if your bank has been part of a recent merger, as that can sometimes trigger a change in routing numbers.

Verifying Your Routing Number to Prevent Errors

Finding your routing number is one thing, but making sure it's the right one for your specific transaction is where it really counts. A single wrong digit can throw a wrench in the works, causing failed payments, frustrating delays, and sometimes even late fees.

Think of verification as your financial safety net. Taking an extra minute to double-check the number now can save you hours of headaches later, whether it's a direct deposit that bounces or an important bill payment that gets rejected.

Avoiding Common Routing Number Blunders

It's surprisingly easy to mix up routing numbers, especially if you bank with a larger institution that uses several different codes. From my experience, a couple of mistakes pop up time and time again:

- ACH vs. Wire: This is a big one. People often use their standard ACH routing number (for direct deposits and automatic bill pay) when they need to send a wire transfer. Wires are a different beast and almost always require a separate, specific routing number.

- Old vs. New: If your bank merged with another one recently, your routing number might have changed. Grabbing an old checkbook from the back of a drawer could mean you're using an outdated number, which will cause the transaction to fail.

Keeping track of changes from bank mergers or new financial startups is a real challenge. In fact, some industry reports show that up to 10% of certain ACH payments don't pass validation simply because of outdated directories. This can lead to banks blocking perfectly legitimate transactions. You can find more data on global payment systems at WorldBank.org.

Crucial Takeaway: Never assume the first routing number you find is correct for every situation. Always consider the transaction type (ACH or wire) and confirm your bank's information hasn't recently changed.

How to Confirm Your Routing Number Is Valid

So, how can you be certain? The most reliable method is to cross-reference the number with an official source. The American Bankers Association (ABA) provides an online lookup tool that confirms a routing number is active and shows you which bank it’s assigned to.

This quick check gives you peace of mind that the information you're providing is accurate before you hit "send." It’s the final, essential step when you need to find routing number details you can absolutely trust.

A Few Common Questions About Routing Numbers

Even after you've found your routing number, a few questions can pop up. Let's clear up some of the most common points of confusion I see all the time.

Is a Routing Number the Same as an Account Number?

Absolutely not, and mixing them up is a classic mistake. They serve two completely different purposes.

Think of it like this: the nine-digit routing number is your bank's address on the national financial map. Your account number, on the other hand, is your unique mailbox at that address. On a paper check, you'll always find the routing number first on the bottom-left, followed by your account number.

Do I Need a Different Routing Number for a Wire Transfer?

This is a big one. More often than not, yes, you do. This trips people up constantly and is a major reason for failed payments.

Most banks, particularly the larger national ones, use one routing number for standard electronic payments (like direct deposits and automatic bill pay, known as ACH transfers) and a totally separate number for domestic wire transfers. They run on different networks. Always double-check with your bank which number is correct for the specific type of transaction you're making.

Pro Tip: Before you initiate any payment, just ask yourself: "Is this a standard electronic payment or a one-time wire transfer?" Answering that simple question will tell you which routing number to look for.

Is It Safe to Give Out My Routing Number?

Sharing your routing number and account number is a normal part of setting up legitimate financial services. Think direct deposit with your employer or automatic payments with your utility company. In those cases, it's generally safe.

The key is to be smart about how you share it. Only enter this information on secure, trusted websites—look for the little padlock and “HTTPS” in the URL. Never send it through an unsecured email or type it in while connected to a public Wi-Fi network.

Can My Routing Number Ever Change?

It's rare, but yes, it can happen. The most common reason for a change is when your bank merges with or is acquired by another financial institution.

If this happens, don't worry. Your bank is required to give you plenty of advance notice. They’ll send you the new routing number and clear instructions on how to update any automatic payments or direct deposits to prevent any disruptions.

Need a voided check for direct deposit but don’t have a checkbook handy? VoidedCheck.org is your best bet. You can generate a fully compliant and professional voided check in less than a minute. Each one is validated against official Federal Reserve data and guaranteed to be accepted.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.