How to Void a Blank Check Safely and Securely

So, you need to provide your banking details but don't want to hand over a live, cashable check. The solution is simple: void a blank check.

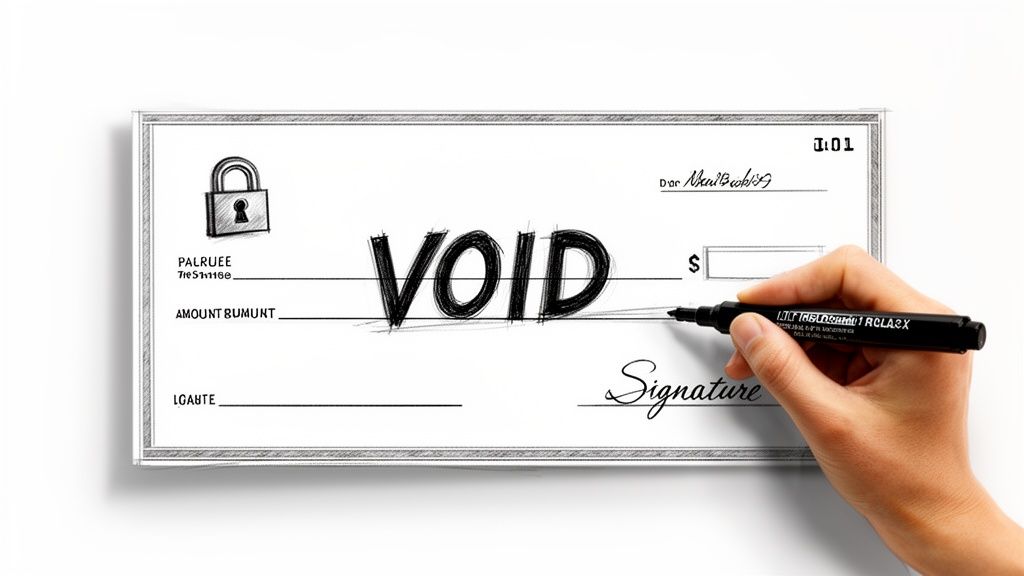

Grab a blue or black pen and write the word VOID in large, clear letters across the front of the check. You'll want to make sure it covers the key payment areas—the payee line, the amount box, and the signature line. Be careful not to write over the routing and account numbers at the bottom. Those need to be perfectly readable.

That's it. This one word renders the check useless for payment but keeps your bank information intact for setting up accounts.

Why Voiding a Check Correctly Is So Important

In a world of digital payments, you might think physical checks are a thing of the past. But knowing how to properly void one is still a crucial financial skill. Think of it as a fundamental security step—your first line of defense against costly mistakes and fraud.

A correctly voided check has a very specific job to do. It securely provides your banking information for legitimate purposes, like when you need to:

- Set up direct deposit with a new employer.

- Authorize automatic bill payments for things like a mortgage or car loan.

- Establish ACH transfers for investment accounts or other recurring debits.

When you hand over a voided check, you're confirming your account and routing numbers without giving someone a blank check they could cash.

Imagine sending a regular blank check to your new company's HR department and it gets lost in the mail. If that check falls into the wrong hands, it’s a golden ticket for a thief. They could fill it out to themselves for any amount they want and try to cash it.

The Alarming Reality of Check Fraud

This isn't just a paranoid "what if" scenario; check fraud is a massive, growing problem. Simply voiding a check is an essential habit to prevent it from being misused.

Recent data shows that in 2023, global check fraud losses soared to $26.6 billion. A shocking 80% of that—more than $21 billion—happened right here in the Americas. These aren't just numbers on a page; they represent real money stolen from everyday people and businesses, often because a blank check wasn't secured. You can dig deeper into these eye-opening check fraud statistics from Advanced Fraud Solutions.

A voided check securely transmits your banking details without handing over a live, cashable document. It connects this simple action to your broader financial safety.

Protecting Your Financial Information

Ultimately, the entire point is to share necessary information (your routing and account numbers) while completely neutralizing the check's ability to be used for payment.

When you write "VOID" across the front, you're putting up a huge red flag that banking systems are trained to recognize. Both automated check scanners and human tellers will reject a check marked this way, preventing it from ever being processed as a payment.

It’s a tiny action that transforms a vulnerable piece of paper into a safe, informational tool. This low-effort, high-impact habit is one of the easiest ways to protect your money and identity.

How to Void a Check the Right Way

Voiding a check seems simple, but doing it correctly is crucial for protecting your money. The main goal is to make the check impossible to cash while keeping your bank account information perfectly clear for things like direct deposit. Let's walk through exactly how to do it and, more importantly, why each step matters.

First off, you need the right tool. Grab a pen or marker with permanent black or blue ink. I can't stress this enough. Using a pencil or a pen with erasable ink is asking for trouble. Anyone with a good eraser could remove the word "VOID" and try to use your check.

Make "VOID" Big and Obvious

With your permanent pen in hand, write the word “VOID” in large, bold letters right across the front of the check. You want it to be the first thing anyone sees.

To be extra safe, make sure your writing covers the most important payment fields. This is the key to neutralizing the check. Specifically, write "VOID" over these three areas:

- The Payee Line: Where you’d normally write who the check is for.

- The Amount Box: The little box for the dollar amount.

- The Signature Line: This prevents anyone from forging a signature and trying to authorize it.

Covering these spots makes it physically impossible for someone to fill out the check and cash it.

Don't Cover Up the Important Numbers

While you want "VOID" to be prominent, be careful not to write over the numbers at the very bottom of the check. That line of digits contains your bank's routing number and your account number—the whole reason you're providing the check in the first place!

Your employer or biller needs to read those numbers clearly to set up your electronic payments. If your writing smudges or obscures them, it can cause processing errors, which means delays in getting your direct deposit or setting up automatic bill pay.

Expert Tip: Should you write on the back of the check, too? It's not always required, but I highly recommend it. Just a quick "VOID" across the endorsement area on the back adds another layer of security. It leaves absolutely no doubt that this check is not valid for payment.

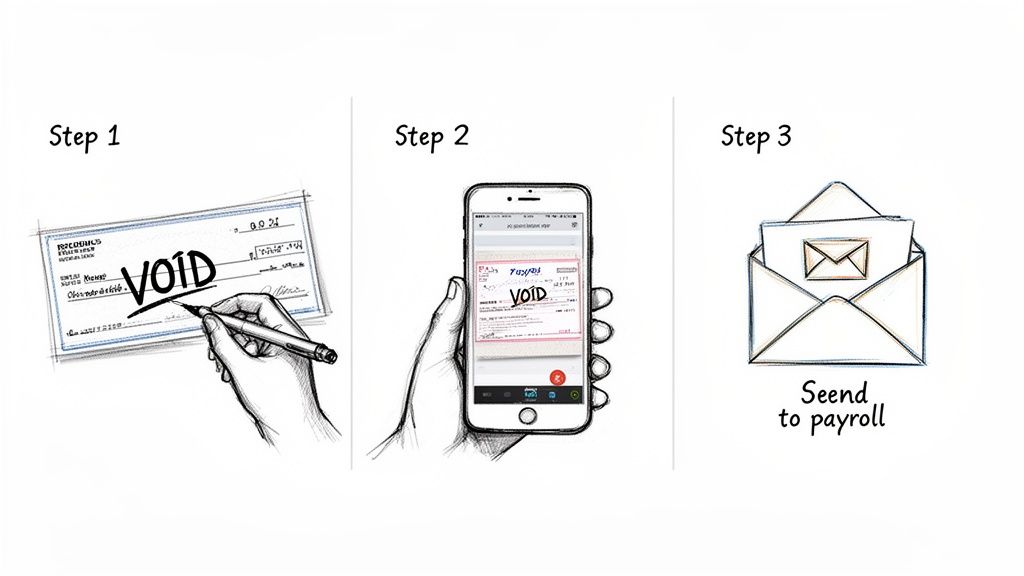

Always Keep a Copy for Your Records

Before you hand over the voided check, make a record of it. This is a simple step that so many people skip, but it can save you a headache later.

You have a couple of easy options:

- Make a photocopy to keep in your physical files.

- Snap a clear photo with your phone of both the front and back.

This copy is your proof. It shows exactly what the check looked like when you sent it and which check number you used. It also makes it easy to track in your check register.

If you don't have a physical checkbook handy, some services can help you generate a voided check online. You can then save the digital file or print it out as needed.

Real-World Scenarios for Using a Voided Check

Knowing how to void a check is half the battle. The other half is understanding why you'd ever need to. This isn't some obscure financial maneuver; it's something you'll likely run into several times in your life.

Let's break down the most common situations where a voided check is exactly what you need to share your banking information safely and accurately.

Setting Up Direct Deposit for Your Paycheck

This is, by far, the most frequent reason you'll need a voided check. You've just landed a new job, and the HR department needs your bank information to get you set up for direct deposit.

Sure, you could just write down your account and routing numbers on a form. But what if you transpose a number? Or what if someone in payroll makes a typo while entering it? A simple mistake could delay your paycheck or, worse, send it to a complete stranger's account.

Handing them a voided check eliminates that risk entirely. It acts as an official, bank-printed source of truth for your account details. It's a simple, foolproof way to get it right the first time.

Automating Your Bill Payments

Another very common use case is setting up automatic payments for recurring bills. Think about your mortgage, car loan, rent, or even your monthly utility bills. To enable an Automated Clearing House (ACH) withdrawal, the company needs to confirm your bank details so they can pull the funds on schedule.

A voided check is the perfect tool for this. It serves as a secure, one-time authorization document. You're providing the necessary information without sending a live, negotiable check through the mail where it could get lost or, even worse, stolen.

A properly voided check prevents a live, usable check from entering the high-risk mail system, where it could be stolen and manipulated. It's a small step that significantly boosts your financial security during routine setups.

And that risk is very real. FinCEN recorded a staggering 15,417 reports of mail theft-related check fraud in just seven months during 2023, flagging over $688 million in suspicious transactions. You can read more about the rise in check fraud from Bottomline. By using a voided check, you share only the necessary info without putting a blank, cashable check in harm's way.

Other Financial Setups

Beyond getting paid and paying bills, a few other financial situations pop up where a voided check is the standard. All of them boil down to the same core need: verifying your bank account for electronic fund transfers.

- Investment Accounts: When opening a new brokerage or retirement account, you'll need to link it to your bank to move money in. A voided check is often the preferred method for establishing that connection.

- Tax Refunds: E-filing your taxes? If you want that refund deposited directly into your bank account, your tax preparer might ask for a voided check to ensure the numbers are 100% correct for the IRS.

- Loan Applications: Some lenders may request a voided check to confirm the account where they will deposit your loan funds or from which they will withdraw your monthly payments.

In every one of these cases, the voided check is playing the same crucial role. It’s a secure, accurate tool for confirming your banking information, protecting you from both innocent typos and serious fraud.

Critical Mistakes to Avoid When Voiding a Check

Knowing how to void a check is one part of the equation. Just as important is knowing what not to do. A few simple slip-ups can turn a routine task into a genuine security risk, leaving your bank account wide open to fraud. Let's walk through the common pitfalls I've seen over the years so you can keep your financial information safe.

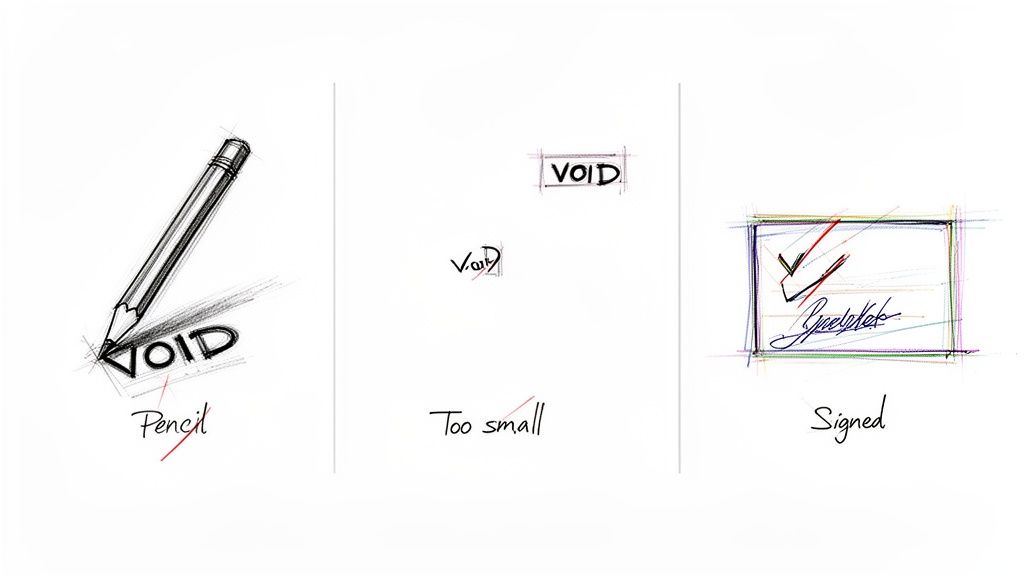

Choosing the Wrong Pen (Or a Pencil)

The most common mistake, by far, is grabbing the wrong writing tool. Reaching for a pencil or one of those fancy erasable pens is a huge no-no. It seems harmless, but all a fraudster has to do is erase the word "VOID" and they're holding a blank check, ready to be filled out.

Stick with a permanent marker or a pen with non-erasable blue or black ink. You want to make a mark that's there for good, leaving no doubt that the check has been permanently canceled.

Not Making Your Intent Clear

This isn't the time to be subtle. I've seen people write "void" in tiny letters in a corner, which defeats the whole purpose. This leaves the most important parts of the check—the payee line and the amount box—completely exposed and ready to be filled in by someone with bad intentions.

Your goal is to make the check unusable. Write "VOID" in big, bold letters right across the middle of the check. Make sure it covers those critical fields. There should be zero ambiguity about its status.

A Quick Word of Warning: Never, ever sign a check you are voiding. A signature is like gold to a forger. Even on a voided check, it can be digitally copied and pasted onto other documents. It's an unnecessary risk.

Opening the Door to Fraud

These small oversights can have big consequences. Criminals are incredibly skilled at exploiting these exact kinds of weaknesses. According to the Federal Trade Commission, fake check scams resulted in $28 million in losses in 2019, with the average victim losing $1,988. Many of these scams start with altered or counterfeit checks, which is why voiding a check correctly is so essential. You can dig deeper into the problem with these check fraud statistics from Refine Intelligence.

Here’s a quick recap of what to steer clear of:

- Don't Use a Pencil: It's too easy to erase.

- Don't Write Too Small: Your "VOID" should be impossible to miss.

- Don't Forget Key Areas: Make sure your writing crosses the payee, amount, and signature lines.

- Don't Sign It: This just adds a layer of unnecessary risk.

- Don't Block the Important Numbers: Be careful not to smudge or write over the routing and account numbers at the bottom (the MICR line). This can cause the document to be rejected by automated systems, leading to delays.

Avoiding these common mistakes is simple once you know what to look for. A little bit of care transforms a potentially vulnerable blank check into a secure, effective tool for setting up your payments.

Modern Digital Alternatives to a Voided Check

Let's face it, a lot of us don't even have a checkbook anymore. So what do you do when HR asks for a voided check to set up your direct deposit? Thankfully, the days of needing a physical piece of paper are mostly behind us. You have a few great digital options that are just as secure and often much faster.

The easiest and most official alternative is a pre-printed direct deposit form from your bank. Most banks let you download one directly from your online banking portal—just log in and look for something like "Account Services" or "Direct Deposit Info." It's an official document with your name, routing number, and account number, which is exactly what your employer needs.

Go Digital with Your Banking App

Your phone is probably your primary banking tool anyway, and it can easily handle this task. Open up your mobile banking app, navigate to your checking account, and look for an "Account Details" or similarly named section. This is where you'll find your routing and account numbers.

From there, you have a couple of straightforward options:

- Take a quick screenshot showing the account and routing numbers.

- Copy and paste the numbers directly into the secure digital form your employer sent you.

This whole process takes less than a minute. It's perfect for when you're onboarding for a new job remotely or just need to get your information over to payroll quickly.

The whole point of a voided check is to provide your banking details accurately and safely. Digital methods—like using an official bank form or your mobile app—accomplish the exact same thing, just without the paper. They're faster, more convenient, and just as secure.

A quick word of caution: if you're sending a screenshot, make sure you're using a secure method. Emailing it to a trusted HR email address is usually fine, but never send financial information over a public Wi-Fi network.

Thinking about how we manage money today, it makes sense that this process has gone digital. Many services you already use, from bill pay to peer-to-peer payments, rely on this same direct deposit information. For example, setting up payments through platforms like Venmo often involves the same steps, highlighting how common digital verification has become. Read more about that here: https://voidedcheck.org/venmo.

The bottom line is you have flexible, secure choices that work for a paperless world.

Physical Voided Check vs Digital Alternatives

Choosing between a traditional voided check and a modern digital alternative often comes down to convenience and personal preference. Here’s a quick breakdown to help you decide which method is best for your situation.

| Method | Pros | Cons |

|---|---|---|

| Physical Voided Check | Universally accepted. Low-tech and simple. | Requires having a checkbook. Slower process (physical delivery). Risk of mail loss or theft. |

| Bank Direct Deposit Form | Official and verified. Secure digital download. | Requires logging into your online bank. May need a printer if a physical copy is required. |

| Mobile Banking App | Extremely fast and convenient. Completely paperless. | Some employers may prefer an official form. Risk of sending to the wrong contact. |

| Online Voided Check Tools | Instantaneous and easy. No checkbook or app needed. | Third-party service; ensure you use a reputable provider. |

Ultimately, whether you write "VOID" across a check or simply take a screenshot in your banking app, the goal remains the same: to securely provide your account information. Today’s digital options simply offer a quicker and more efficient path to get it done.

Your Top Questions About Voiding a Check, Answered

Even with the basics down, you might still have a few questions when it's time to actually void a check. It’s totally normal to want to get it right, especially when your banking info is on the line. Let’s clear up some of the most common things people ask.

Can I Void a Check I’ve Already Filled Out?

Absolutely. You can void a check even if it's already been written out and signed. Maybe you wrote a check for a utility bill, then remembered you'd already set up autopay. No problem.

Just grab the check and write “VOID” in big, bold letters right across the front. Do it the same way you would with a blank one. This simple act makes the check worthless and ensures it can't be cashed.

A quick pro tip: Make a note in your check register next to that check number. It'll save you a headache later when you're trying to balance your account.

Should I Let My Bank Know I Voided a Check?

For most situations, no, you don't need to call your bank. If you're voiding a blank check to set up direct deposit or simply decided not to send one you wrote, the bank doesn't need to be involved. Since the check will never make it to them, there's nothing for them to process.

The big exception is if the check is already out of your hands—say, you dropped it in the mail. In that scenario, voiding a copy at home does nothing. You need to call your bank immediately and request a stop payment order. This is a formal action they take to block the check if someone tries to cash it. Just be aware that most banks charge a fee for this service.

A stop payment is your emergency brake for a check that's already in circulation. Voiding a check is like never starting the car in the first place.

What if I Don't Have a Physical Checkbook?

You’re not alone—this is a super common issue these days. Luckily, you have plenty of great options that don't involve ordering a box of checks you'll never use. Most companies are now perfectly happy to accept a digital alternative.

Here are a few solid choices:

- A Direct Deposit Form: Most banks let you download a pre-filled form directly from your online account. It’s official and has everything needed.

- A Bank-Issued Letter: You can also ask your bank for an official letter printed on their letterhead. It will clearly state your name, account number, and routing number.

- A Banking App Screenshot: Sometimes, a simple, clear screenshot from your mobile banking app that shows your account and routing numbers will do the trick.

- Online Check Generators: If you need something that looks and feels like a real check, a service like VoidedCheck.org can generate one for you on the spot.

Before you go through the trouble, it’s always a good idea to just ask the company what format they prefer.

Is It Safe to Email a Picture of a Voided Check?

Sending a voided check over email can be safe, but you have to be smart about it. The most important step is to double-check that you have the right email address. You want to be sending it to a secure, official corporate address (like an HR department), not a personal Gmail or Yahoo account.

If you want an extra layer of security, you can password-protect the image file before you attach it. Then, send the password in a separate message, like a quick text. That way, even if the email gets into the wrong hands, the attachment itself is still locked down and unreadable.

Need a voided check right now but don't have a checkbook? VoidedCheck.org lets you generate a professional, universally accepted voided check in under 60 seconds. It's fast, secure, and perfect for setting up direct deposit or automatic payments without the hassle. Create your voided check instantly at https://voidedcheck.org.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.