Voided Check or Deposit Slip for Direct Deposit

When you're asked for a voided check or deposit slip to set up direct deposit, it can be a little confusing. Here's the short answer: a voided check is always the safer, more universally accepted choice. Why? Because it has all your account details in a standard, machine-readable format that practically eliminates errors and payment delays.

Choosing Between a Voided Check and a Deposit Slip

Deciding whether to hand over a voided check or a deposit slip is a common hiccup, especially when you're starting a new job or setting up automatic bill payments. While both are tied to your bank account, they're built for completely different jobs and contain different information. Getting this right from the start is the key to making sure your financial setups go off without a hitch.

A voided check is simply a blank check from your checkbook with "VOID" written across the front. This action cancels its use for payment but leaves it perfectly intact for one crucial purpose: verifying your banking information. Employers, for example, almost always ask for one to set up payroll. This gives them the exact routing and account numbers they need, which is why it's a key part of ensuring you get paid on time, every time. You can learn more about this process in a helpful guide on voided checks for payroll.

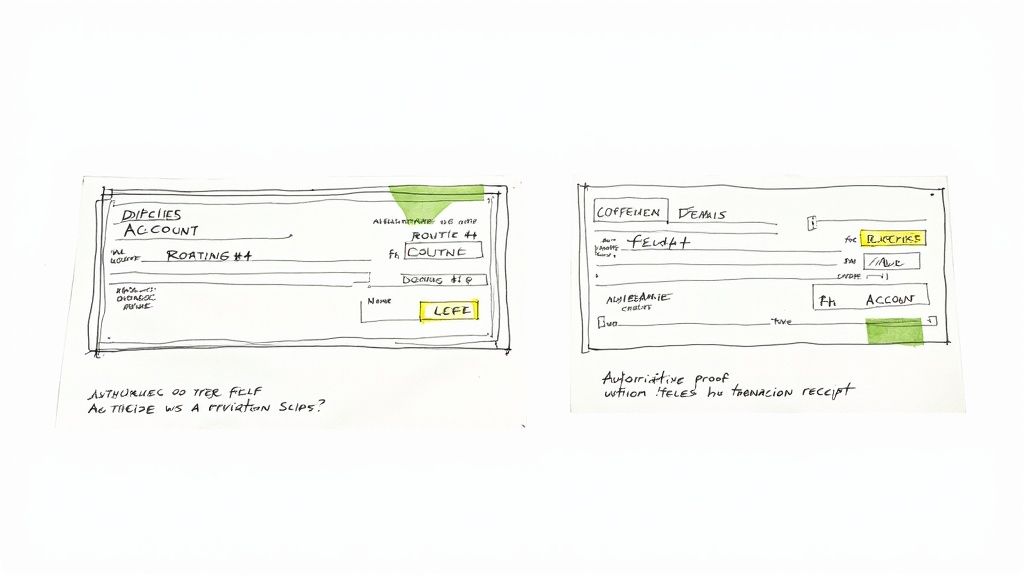

Quick Comparison Voided Check vs Deposit Slip

To put it simply, these two documents are not created equal when it comes to account verification. This table offers a snapshot of the key differences, helping you quickly understand the primary function and reliability of each.

| Attribute | Voided Check | Deposit Slip |

|---|---|---|

| Primary Purpose | Account verification for electronic transfers | Recording a transaction (deposit) at a bank |

| Information Provided | Account holder name, address, routing number, account number | Typically only account holder name and account number |

| Routing Number | Always present and correct for ACH transfers | Often missing or may show an internal branch number |

| Universal Acceptance | High - The gold standard for most organizations | Low - Frequently rejected for direct deposit setup |

| Risk of Error | Low, due to machine-readable format | High, due to missing information and manual entry |

As you can see, the voided check is the clear winner for reliability and acceptance. It’s designed to provide the complete, accurate information needed for electronic transactions, while a deposit slip is just a receipt for a bank transaction.

A Detailed Analysis of Each Document

To really get why one document is the go-to for setting up payments and the other isn't, we need to look past their surface-level connection to your bank account. Think of it this way: a voided check is like a master key, designed to grant electronic access for deposits and withdrawals. A deposit slip, on the other hand, is just a receipt confirming a transaction you already made.

This core difference shapes the information they carry. A voided check is essentially your account's official ID card, packed with all the standardized details that automated systems need to work flawlessly. A deposit slip? It's more of a simple transaction memo.

Unpacking the Information on a Voided Check

When you hand over a voided check to your employer, their payroll system gets a complete, error-proof data package. It’s not just about having the right numbers; it’s about providing them in a universally recognized format that every financial institution trusts.

Here’s what makes it so reliable:

- Account Holder Information: Your full name and address are printed right there, confirming your identity.

- Account Number: This is the unique string of digits that points directly to your specific account.

- ABA Routing Number: A crucial nine-digit code that tells payment systems which bank to send the money to. It's essential for any electronic funds transfer (ACH).

- Bank Information: The name and sometimes the address of your bank are also clearly listed.

All this critical data is printed along the bottom in a special, machine-readable format known as the MICR line (Magnetic Ink Character Recognition). This single feature is what makes a voided check the gold standard—it virtually eliminates the risk of typos and data entry mistakes.

Examining the Limits of a Deposit Slip

A deposit slip, by contrast, was designed for one simple job: helping a bank teller credit funds to the right account. It was never meant to be an official verification document for outside companies. As a result, it often falls short of providing the necessary details for setting up electronic payments.

The biggest problem with a deposit slip is that it often leaves off the ABA routing number. Without that critical nine-digit code, an ACH transaction like direct deposit simply cannot be processed. It’s a guaranteed rejection.

To put it in perspective, both documents link back to your bank account, but they serve entirely different masters. Deposit slips are for internal bank processes—they confirm where money went. As many people discover when setting up payroll, they frequently lack the routing number needed for ACH transfers, as detailed in this helpful online forum discussion.

This comparison chart breaks down exactly why these two documents are not interchangeable.

Feature-by-Feature Document Breakdown

| Comparison Point | Voided Check Details | Deposit Slip Details |

|---|---|---|

| Primary Data | Account Holder Name, Address, Account Number, ABA Routing Number, Bank Name | Account Holder Name, Account Number, sometimes Bank Branch Info |

| ABA Routing Number | Always included on the MICR line. Essential for ACH transactions. | Often missing. Not a standard feature, making it unreliable for setup. |

| Machine-Readable | Yes, the MICR line allows for automated, error-free data capture. | No. Information is typically handwritten or printed without a scannable format. |

| Security Level | High. Provides a complete, verified snapshot of the account's details. | Low. Lacks comprehensive data and is not intended for external verification. |

| Primary Use Case | Setting up direct deposit, automatic bill payments, and other ACH transfers. | Documenting cash or check deposits made in person at a bank branch. |

| Employer Acceptance | Universally accepted as the standard for payroll setup. | Frequently rejected due to missing information, causing payment delays. |

Ultimately, the table makes it clear. While a deposit slip proves an account exists, it just doesn't have the complete, authoritative, and machine-readable data required for today's electronic financial systems. The voided check remains the undisputed champion because it delivers every piece of information needed, formatted for accuracy and speed.

Deciding Which Document to Use in Practice

Knowing the technical difference between a voided check and a deposit slip is one thing, but knowing which one to grab in a real-world situation is what actually matters. The choice isn't about personal preference; it's about meeting specific requirements to make sure your direct deposit or automatic payment gets set up without a hitch.

The decision really boils down to who is asking and what they need it for. For just about any electronic financial setup, the voided check has long been the gold standard. A deposit slip, on the other hand, is almost never a proper substitute and usually gets rejected.

When a Voided Check Is a Must

Most of the time you’re asked for banking information to set up automated payments or deposits, you should immediately think "voided check." The company or employer on the other end needs your complete and accurate account and routing numbers to create a secure link for electronic fund transfers (ACH).

Here are the most common times you’ll absolutely need a voided check:

- Setting Up Direct Deposit: Your employer's payroll system relies on the ABA routing number to send your paycheck to the right bank. A deposit slip often doesn't have this, making a voided check crucial for getting paid on time.

- Authorizing Automatic Bill Payments: When you set up recurring withdrawals for your mortgage, car loan, or utility bills, companies need a voided check. It guarantees they're pulling money from the correct account every single month.

- Linking External Bank Accounts: If you're connecting your checking account to a new brokerage or high-yield savings account, a voided check is the standard way they verify your information.

The rule of thumb is simple: if money is moving electronically into or out of your account, the organization asking will almost always need the full details that only a voided check can provide.

When a Deposit Slip Might Be Okay

The list of situations where a deposit slip is acceptable is incredibly short and usually involves less formal, internal processes. Since it’s often missing the all-important routing number, its use is very limited.

You might only consider using a deposit slip in these rare cases:

- In-Person Bank Transactions: A bank teller might ask for a pre-filled deposit slip just to speed up a transaction while you're standing at the counter.

- Basic Proof of an Account: In some informal scenarios, someone might just need to confirm you have an account at a certain bank. A deposit slip can sometimes work as simple, non-transactional proof.

When it comes down to it, if you have any doubt, always go with the voided check. It’s universally accepted and contains all the necessary data, making it the safer and more reliable choice for nearly every financial verification request. Today, many financial institutions offer digital direct deposit forms, and you can explore the different options available from various banks and their specific requirements online.

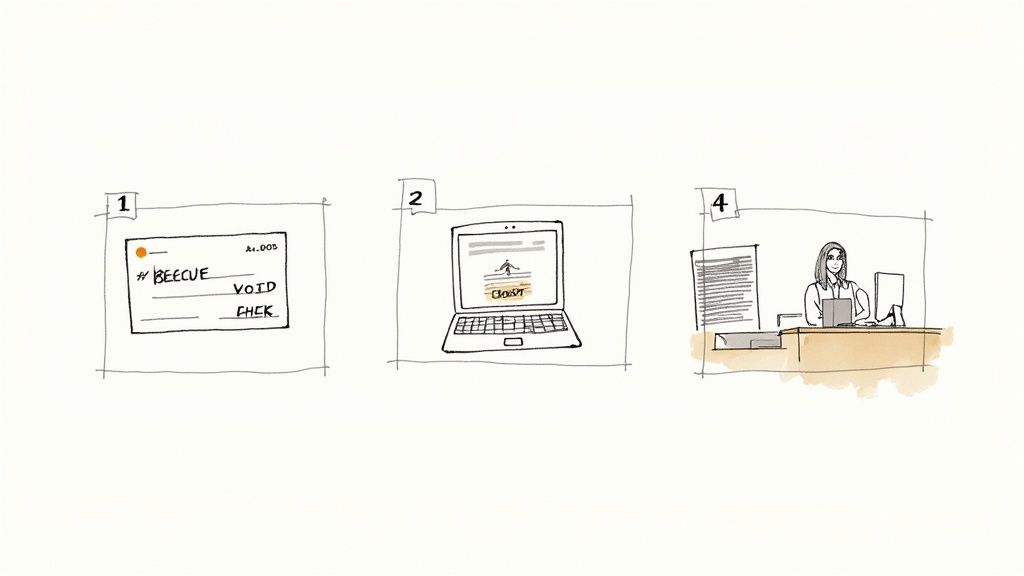

How to Get Your Hands on a Voided Check or Deposit Slip

So, your new employer or a company you're paying needs a voided check or deposit slip. If you're like most people who haven't touched a physical checkbook in years, this request can feel like a bit of a scramble. Don't worry—getting what they need is easier than you think, with both old-school and new-school methods to get it done fast.

Whether you need a physical piece of paper or a digital version, the goal is the same: provide your account details correctly and securely. Let's walk through how to do it right.

The Old-Fashioned Way: Physical Checks and Slips

If you still have a checkbook tucked away in a drawer, this is by far the most direct route. A physical voided check is universally understood and accepted.

Here’s how to void a check correctly:

- Grab a blank check from your checkbook. Pro-tip: pull one from the middle, not the first few "starter" checks, as some companies prefer the fully printed ones.

- Take a pen (blue or black ink is best) and write "VOID" in big, clear letters across the face of the check.

- Make sure your "VOID" covers the payee line, the amount box, and where you'd normally sign. The key is to disable the check without covering up the routing and account numbers at the bottom—that's the info they actually need.

Need a deposit slip instead? You'll usually find a stack of them in the back of your checkbook. If you've used them all up, just pop into a local branch of your bank. A teller will be happy to print one for you right there.

The Modern Fix: Digital Alternatives

In a world of online banking, physical checks are becoming rare. Thankfully, banks have caught on and now offer digital documents that work just as well as a voided check. This is a lifesaver if you bank online-only or just can't find that checkbook.

Your first stop should be your bank's website or mobile app. After logging in, poke around in sections like "Account Services," "Documents," or "Direct Deposit Information." You're looking for one of these:

- Direct Deposit Authorization Form: This is a PDF your bank generates for you. It neatly lists your name, routing number, and account number, making it official.

- Digital Voided Check Image: Some banks offer a downloadable image of a check with all your account information pre-populated. It's the digital twin of a physical voided check.

- Bank Verification Letter: Think of this as an official note from your bank on their letterhead, confirming all your account details. It’s a solid, authoritative substitute.

A Quick Security Tip: When you download any of these documents, make sure you're on a secure, private Wi-Fi network (like at home). Avoid using public Wi-Fi at a coffee shop or airport. It's a simple step to keep your financial data from falling into the wrong hands.

What if you're in a hurry and can't find what you need on your bank's website? An online generator is a great alternative. A secure service can create a valid voided check for you in seconds. This is especially helpful when your bank’s online portal is confusing or doesn’t offer a simple digital option.

As you can see, a good tool makes it a simple, three-step process. You can instantly create what you need at https://voidedcheck.org/generator, getting the right document for your payroll or billing setup in less than a minute.

The Future of Digital Account Verification

Let's be honest, the days of digging through a drawer for a paper voided check or deposit slip are numbered. While they still work in a pinch, the financial world is sprinting toward faster, safer digital methods that cut out the paperwork and the waiting game. This whole shift is about making things quicker, more accurate, and a lot more secure when it comes to confirming bank account details.

Modern payroll systems and financial apps are increasingly building in something called Instant Bank Verification (IBV). You've probably seen it. It's that slick process where you securely log into your bank's website through a service like Plaid to instantly connect your account. That direct digital handshake confirms everything in seconds, no manual typing required.

Why Digital Verification Is Taking Over

Moving away from paper isn't just for convenience; it brings some serious benefits. For employers and companies, it kills the risk of someone mistyping a routing or account number from a grainy photo of a check. For you, it means your direct deposit gets set up right away, not next week.

Here’s why it’s a better way to go:

- Enhanced Security: Your bank login details are never actually seen or stored by your employer. The whole thing happens through an encrypted, token-based connection.

- Immediate Confirmation: The system verifies you own the account in real-time. That means direct deposits or bill payments can be scheduled on the spot.

- Reduced Fraud: IBV is great at stopping fraud because it confirms the person setting up the payment is the actual account holder.

This isn't just a trend; it's a direction pushed by the big players. Nacha, the organization that runs the whole ACH network in the U.S., has been a huge proponent. Back in 2022, they started urging employers to switch to digital verification over collecting paper checks. Their goal is to make direct deposit smoother and safer for millions of us. You can even read about Nacha’s push to modernize direct deposit setups directly from them.

The Role of the Voided Check Today

So, with all this new tech, is the voided check dead? Not quite. It’s settled into a new role as the reliable, old-school backup. It’s still a crucial and widely accepted way to verify an account.

Many smaller businesses haven’t integrated IBV systems yet, and frankly, some people just aren't comfortable linking their bank accounts through a third-party app. That's perfectly fine.

A voided check serves as an essential, universally understood alternative when digital verification isn't an option. It provides a tangible, authoritative document that any payroll department can process, ensuring no one is left behind by technological shifts.

That's why knowing how to get a voided check or deposit slip is still a practical skill. Whether you grab a physical check, download a form from your bank's website, or use a secure tool like VoidedCheck.org, having one ready means you can set up payments anywhere. The future is definitely digital, but the humble voided check still acts as a vital bridge between yesterday's methods and today's technology.

Common Questions About Account Verification

Even when you know the difference between a voided check and a deposit slip, real-world questions pop up all the time. What if you're out of checks? Is it safe to email a voided check? Getting these details right is key to avoiding rejected forms and payment delays.

Let's walk through some of the most common questions people ask so you're ready for anything.

Can I Use a Deposit Slip if I Run Out of Checks?

I wouldn't recommend it. Most organizations specifically ask for a voided check for one simple reason: it guarantees the nine-digit ABA routing number is present and correct for electronic transfers. Deposit slips sometimes use a different, internal branch number, which will cause any ACH transaction to fail.

Submitting a deposit slip when a voided check was requested will almost certainly get your form kicked back, slowing down your direct deposit setup. Instead of taking that risk, log into your online banking portal to download a direct deposit form or use a trusted service to create a digital voided check instantly.

Is It Safe to Send a Voided Check Over Email?

It’s done all the time, but you have to be smart about it. Standard email isn't encrypted, which means the sensitive info on that check—your name, address, account number, and routing number—could be at risk if your email is compromised.

Before you hit send, always double-check that you're sending it to a legitimate, trusted recipient. The safest bet is to use an organization's official, encrypted portal for document uploads if they have one. And it should go without saying, but never post an image of a voided check on a public platform.

For a little extra security, you can password-protect the PDF file before attaching it. Just be sure to share the password with the recipient through a different channel, like a quick phone call or text message. That way, even if the email gets intercepted, the document itself is still locked down.

What if My Online Bank Does Not Issue Checks?

This is a really common situation now, especially with online-only banks. The good news is that these banks are built for this and have great alternatives that are accepted everywhere.

Your first move should be to log into your online banking portal or mobile app. Head to the "Account Services" or "Documents" section, and you'll likely find one of these options:

- A Pre-Filled Direct Deposit Form: A downloadable PDF that officially lists your name, routing number, and account number.

- A Digital Voided Check Image: Many banks can now generate an official image of a voided check with all your details right on it.

- An Official Bank Letter: You can usually request a formal letter on bank letterhead that verifies all the necessary account info.

If you can't find these yourself, a quick call or chat with your bank's customer support will solve it. They can usually email you the document you need on the spot.

Does Writing VOID on a Check Make It Fully Secure?

Writing "VOID" in big, bold letters across the front of a check makes it non-negotiable. This means it can't be cashed or deposited. It's a clear signal to any bank or payment processor that the check is only meant to verify your account information.

To really secure it, don't just write it once. For best results, write "VOID" on the payee line, in the payment amount box, and right over the signature line. This makes it impossible for anyone to try and alter the check for fraudulent purposes. Once you've sent it, it's always a good idea to keep a digital or physical copy for your records.

Still need a fast, reliable way to create a verification document? VoidedCheck.org generates a professional, compliant voided check in under a minute, accepted everywhere for direct deposit and bill payments. Get your secure voided check now.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.