What Information Is Needed for Direct Deposit Explained

Getting direct deposit set up is pretty simple, but it all comes down to getting the details exactly right. You’ll generally need four key pieces of information: your full name, your bank's routing number, your specific account number, and whether it's a checking or savings account.

Think of it like this: these four details are the precise mailing address for your money. If one part is wrong, your paycheck could end up delayed or, worse, sent to the wrong place entirely.

Your Direct Deposit Checklist: The Core Information You Need

While the process is usually quick, accuracy is everything. A single mistyped number can cause a real headache. That’s why I always recommend gathering everything you need before you sit down to fill out the form, whether it’s on paper or online.

In the United States, the system is standardized. Every employer, government agency, or payroll company needs the same basic info: your name, bank account number, the nine-digit routing number (also called an ABA number), and the account type. This consistency is what makes the whole system work so reliably, a topic the FDIC covers in its efforts to modernize payments.

Key Takeaway: Think of your routing number as your bank's street address and your account number as your specific apartment number. You absolutely need both to make sure the delivery goes to the right door.

To make this crystal clear, here’s a quick summary of what you'll need and where to find it.

Direct Deposit Information At a Glance

This table breaks down each piece of the puzzle, so you can quickly pull together your details.

| Information Needed | What It Does | Where to Find It |

|---|---|---|

| Full Name | Verifies you're the official owner of the account. | Your government-issued ID and bank statements. |

| Routing Number | Points the money to the right bank or credit union. | The bottom-left of a check, your bank's mobile app, or online portal. |

| Account Number | Identifies your specific account within that bank. | The bottom-middle of a check, your bank's mobile app, or online portal. |

| Account Type | Tells them whether to deposit into Checking or Savings. | Your online banking dashboard or a recent bank statement. |

Having these details handy will make setting up your direct deposit a breeze. Most of this info is right at your fingertips in your bank's mobile app or on a paper check.

Finding Your Routing and Account Numbers with Confidence

To get direct deposit set up, you really only need two key pieces of information: your routing and account numbers. Think of them as the specific address for your money.

The routing number is like your bank's ZIP code. It’s a nine-digit number that tells the payment system which financial institution gets the money. Your account number is the next part of the address, like your specific house number, telling the bank exactly which account to drop the funds into.

It's surprisingly easy to mix these two up, which can cause frustrating payment delays. The simplest place to find them, without a doubt, is on a physical check.

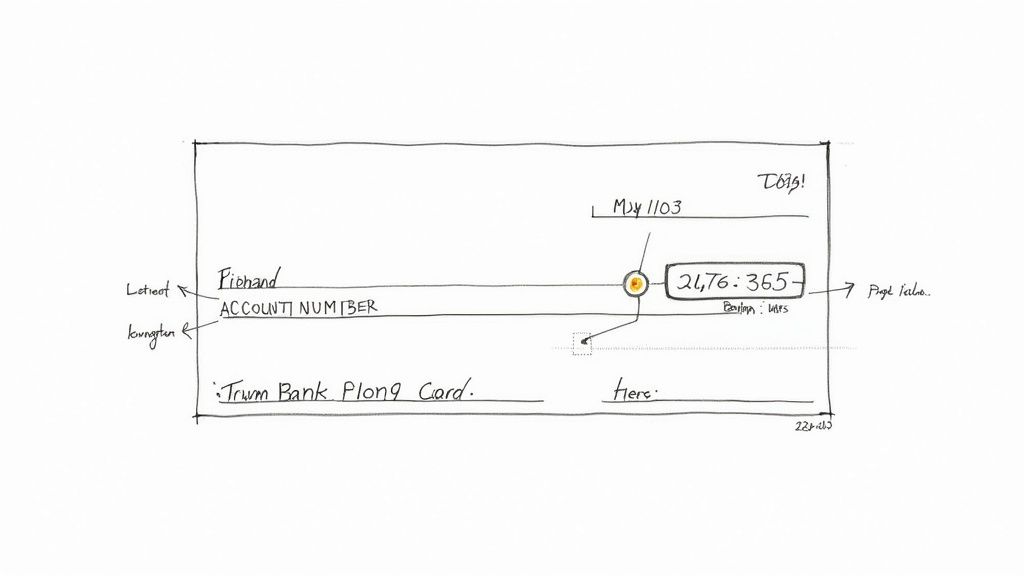

Where to Look on a Paper Check

If you have a checkbook handy, you're in luck. A paper check lays everything out in a standard format at the bottom, printed in that special magnetic ink.

As the image shows, that first set of nine digits on the far left is your routing number. The number right next to it, in the middle, is your account number. Simple as that.

No Checks? No Problem

Let's be real, a lot of us don't use paper checks anymore. Thankfully, your bank provides this info in a few other secure spots.

- Your Bank’s Mobile App: Just log in and tap into your account details. Most banking apps have a clear section that displays your full routing and account numbers.

- Online Banking Portal: Same idea as the app. Log into your bank's website and look for your account summary or details page. The numbers will be listed there.

- Bank Statements: Whether you get them in the mail or online, your account number is almost always printed near the top of your bank statements. The routing number is usually there, too.

- A Pre-Filled Direct Deposit Form: Some banks make it super easy by letting you download a ready-to-go direct deposit form straight from their website, with all your details already filled in.

Pro Tip: What if your employer asks for a voided check but you don't have any? You can create a digital one on the spot. A voided check generator gives you a professional-looking document that works perfectly for setting up direct deposit, saving you the hassle of ordering a checkbook you'll never use.

How to Submit Your Direct Deposit Information Securely

You’ve got all your banking details ready to go. Now for the final, crucial step: actually getting them to your employer. How you hand over this information is just as important as gathering it, because your financial security is on the line.

These days, most companies have you enter everything through a secure online portal, often part of a larger HR system like Workday or ADP. These platforms are built with strong encryption, making them the safest bet for protecting your private data. If your HR department sends you a link to a portal, that's the route you want to take.

Protect Your Financial Data

Here's a hard and fast rule: never send your banking information over standard email. It’s like sending a postcard through the mail—anyone who intercepts it can read everything on it. With a 2024 report highlighting a rise in data breaches, using secure channels isn't just a suggestion; it's essential.

Think of your bank account and routing numbers as the keys to your financial kingdom. You wouldn't leave your house keys lying around, so treat this information with the same high level of care you'd give your Social Security number or passwords.

What if your employer uses old-school paper forms? Fill it out completely and deliver it by hand directly to someone in HR you trust. Don't just leave it on a desk where anyone could walk by and see it. It’s always a good idea to understand how your information is handled, which you can learn more about by reviewing a digital privacy policy.

The Pre-Submission Accuracy Checklist

Before you click that "submit" button or hand over the form, take 30 seconds to run through this quick checklist. You'd be surprised how often a simple typo is the culprit behind a delayed paycheck.

- Account Number: Did you double-check every single digit? Are they in the correct sequence?

- Routing Number: Is the nine-digit routing number entered perfectly?

- Account Type: Did you tick the right box? Checking or Savings?

- Name: Does the name you wrote down match your bank account name exactly? No nicknames or abbreviations.

This final check is your best defense against frustrating payment delays. It’s a tiny bit of effort that ensures your hard-earned money lands where it’s supposed to, right on time.

Direct Deposit Information Around the World

While the U.S. system of routing and account numbers is straightforward for domestic payments, things get a bit more complex once you cross borders. If you work with international clients or a multinational company, the information needed for direct deposit can look quite different.

Think of these international codes as different addressing formats for the global financial mail system. Instead of a ZIP code and street address, other countries use their own unique identifiers to make sure payments arrive safely. Getting familiar with these variations is crucial for anyone involved in cross-border transactions.

Key International Banking Codes

For payments outside the United States, you'll likely run into a few common systems. Each one is built for a specific region's banking network, but they all share the same goal: directing money to the right place.

- IBAN (International Bank Account Number): The standard across Europe, the Middle East, and the Caribbean, an IBAN is a long alphanumeric code. It conveniently bundles the country code, bank, and specific account number all into a single string.

- SWIFT/BIC (Society for Worldwide Interbank Financial Telecommunication/Bank Identifier Code): This is the universal code for identifying a specific bank anywhere in the world. You’ll often see it requested alongside an IBAN for international wire transfers and some direct deposits.

In the European Union, the Single Euro Payments Area (SEPA) requires both an International Bank Account Number (IBAN) and a Bank Identifier Code (BIC) for all direct deposits made in euros. As of 2024, SEPA included 36 countries and processed over 50 billion credit transfers annually. You can find more global banking trends from Moody's in their latest reports.

Other countries have their own localized systems. For example, Canada uses a combination of a five-digit transit number and a three-digit institution number. Meanwhile, the United Kingdom relies on a six-digit sort code to identify the specific bank and branch.

The world of international payments is built on a diverse set of codes, each tailored to its home region's banking infrastructure. The table below breaks down the key identifiers used in several major economic areas, showing how different systems achieve the same goal of routing funds correctly.

Global Direct Deposit Codes Compared

| Region/Country | Primary Bank Identifier | Primary Account Identifier |

|---|---|---|

| United States | Routing Number (9 digits) | Account Number |

| Europe (SEPA) | SWIFT/BIC (8-11 characters) | IBAN (up to 34 characters) |

| United Kingdom | Sort Code (6 digits) | Account Number |

| Canada | Transit & Institution Number | Account Number |

Ultimately, whether it's a sort code in the UK or an IBAN in Germany, the principle is the same. Each code provides the necessary instructions to guide your money from one account to another, no matter the distance.

Troubleshooting Common Direct Deposit Problems

Even when you've double-checked every number, hiccups can still happen. The good news is that most direct deposit issues are simple mix-ups, not major disasters, and they’re usually easy to fix if you act quickly. So, don't panic if your paycheck doesn't show up right on schedule.

One of the most common reasons for a delay, especially with your first payment, is a "pre-note" test. Think of it as a test run. Your employer sends a zero-dollar transaction to your bank just to make sure the account and routing numbers are valid. This verification process sometimes means your first paycheck comes as a paper check while the test goes through.

My Direct Deposit Did Not Arrive

If payday comes and goes and your bank account is still empty, it's time to do a little detective work. Here’s a simple, step-by-step plan to get things sorted out.

Confirm with Your Employer: Your first stop should be your company's HR or payroll department. Ask them to confirm two things: that the direct deposit was actually sent and the exact bank details they have on file for you.

Check for Typos: A single wrong digit is the number one cause of direct deposit fails. A transposed number in your account or routing information can send your money to the wrong place or have it rejected entirely. If you spot a mistake, get it corrected with HR for the next pay cycle. They'll work on getting you the missing payment, which is often issued as a paper check in the meantime.

Contact Your Bank: If your employer swears everything is correct on their end, the next call is to your bank. Give them any transaction details your payroll department can provide, as this will help them trace the missing payment.

Most direct deposit errors are just simple clerical mistakes and can be resolved within one or two business days. Clear communication with your payroll department is the key to fixing the problem fast.

Taking a proactive approach will save you a lot of stress. And remember, the best way to solve a problem is to prevent it from happening in the first place—so always double-check those numbers before you hit submit

Got Questions About Direct Deposit? We've Got Answers.

Alright, so you've got the basics down. But a few common questions always seem to pop up when you're setting things up for the first time. Let's walk through them so you can get everything sorted out without any payday surprises.

Can I Use a Digital Bank or a Mobile Wallet?

Absolutely. Digital-first options like Chime, Varo, or even Cash App work just like traditional banks when it comes to direct deposit. They all issue a standard routing and account number that you can give to your employer.

Just pop open the app and look for a section like "Account Details" or "Move Money"—the numbers will be right there. For your employer, sending money to one of these is no different than sending it to a big national bank. It's the same secure, standard process.

No matter where you bank, the core information needed is pretty much the same. That consistency is what makes the whole system work so smoothly. Of course, this can look a little different in other parts of the world. For example, in many Sub-Saharan African countries, mobile money accounts are the norm for payroll, often requiring just a mobile number and national ID. You can dig deeper into how these core deposit trends are evolving on mercercapital.com.

How Long Does It Take for the First Direct Deposit to Hit?

Patience is key here. It typically takes one to two pay cycles for your first direct deposit to start. This isn't just your employer dragging their feet; they often run a "pre-note" test. This is basically a zero-dollar transaction sent to your bank just to confirm the account details are correct and active.

If you happen to turn in your form right before payday, don't be surprised if you get one last paper check while they verify everything. Your HR department should be able to give you a solid timeline for when to expect your first electronic payment.

What Happens If I Mess Up the Numbers?

Mistakes happen, but this is one place you really want to be careful. If you enter an incorrect account or routing number, the deposit will fail. Best-case scenario? The numbers don't correspond to any real account, the transaction gets rejected, and the money bounces back to your employer. They'll likely cut you a paper check, but your pay will be delayed.

Important: The real headache begins if you accidentally type in someone else's valid account number. The money could end up in their account, and getting it back is a complicated process. This is why you should double-check every single digit before you hit submit.

Can I Split My Paycheck Between Different Accounts?

Yes, and you absolutely should! Most employers let you split your direct deposit, which is a fantastic and effortless way to build your savings.

Look for an option on your direct deposit form or in your company's payroll portal to add a second (or even third) bank account. You can then choose how to divide your pay—either by a set dollar amount or by a percentage. For instance, you could automatically send 20% of every paycheck to a high-yield savings account and have the remaining 80% land in your primary checking account.

Generate a Voided Check for These Banks

Related Articles

What Is a Void Check for Direct Deposit and How Do You Get One

What is a void check for direct deposit? This guide explains why you need one, how to void a check, and how to get one instantly without a physical checkbook.

Choosing the Best Payroll Software for Small Business

Compare the best payroll software for small business. Our expert guide reviews features, pricing, and use cases to help you choose the right solution.

Where can i get a voided check: Quick, safe ways online or at your bank

Learn where can i get a voided check and other quick options online or at your bank for easy direct deposit.